The world has shifted dramatically since the peak of COVID lockdowns, and the ripple effects are still being felt across various sectors. From affordable internet access to changing housing markets, here's a look at some key trends emerging in a post-COVID landscape.

Big Telecom vs. Affordable Broadband

In New York State, a battle has been brewing between Big Telecom companies and advocates for affordable internet access. During the COVID lockdowns, New York passed a law mandating that Internet Service Providers (ISPs) with over 20,000 subscribers offer a 25 Mbps broadband tier for just $15 a month to low-income residents. This initiative aimed to bridge the digital divide, ensuring that everyone has access to essential online services.

Predictably, Big Telecom wasn't thrilled. They launched a multi-year effort to kill the law, which was first passed in 2021. However, their attempts recently fell apart, marking a significant victory for low-income communities. This could set a precedent for other states looking to ensure equitable access to broadband.

“This is a huge step forward for digital equity,” says Sarah Jones, a local advocate. "Affordable broadband isn't a luxury; it's a necessity in today's world.”

The New Cotswolds? Rural Villages Boom

Across the pond in the UK, a different kind of shift is underway. Picture this: charming countryside villages nestled along the River Great Ouse in Bedfordshire. Places like Bromham, Sharnbrook, Harrold, and Turvey are experiencing a surge in popularity. Why? They're becoming a more affordable alternative to the upscale Cotswolds.

Since the COVID lockdown, families have been flocking to these picturesque settlements, attracted by homes that are approximately £200,000 cheaper than those in the Cotswolds. The appeal of rural life, combined with greater affordability, is driving this trend.

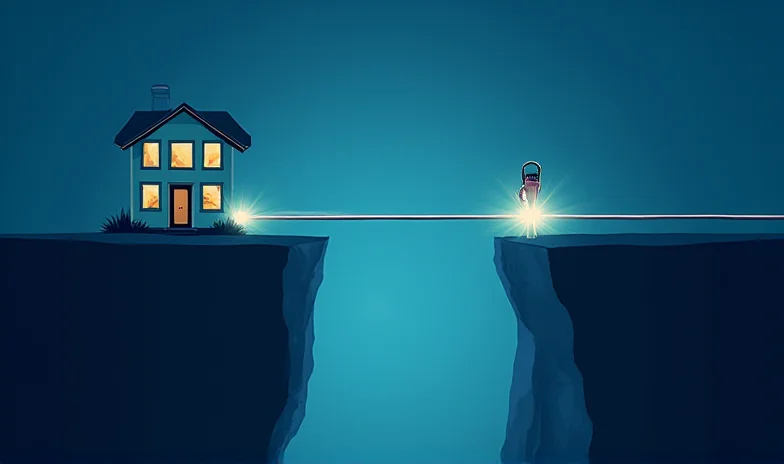

Economic Uncertainty on the Horizon?

While some sectors are experiencing growth and positive change, other indicators point to potential economic challenges. A new forecast from the Federal Reserve (the Fed) suggests that the stock market might be headed for a crash. Excluding the COVID-19 pandemic, this would mark a first for the U.S. economy since 2009. This ominous clue has investors and economists on high alert, carefully monitoring market trends.

Of course, not all financial news is negative. The New York State Common Retirement Fund recently increased its position in NuScale Power Co., demonstrating confidence in the company's future. This move reflects a broader trend of investment in sustainable energy solutions.

The post-COVID world is a complex and ever-evolving landscape. From the fight for affordable broadband to shifts in housing markets and potential economic headwinds, the challenges and opportunities are abundant. Only time will tell how these trends continue to shape our future.