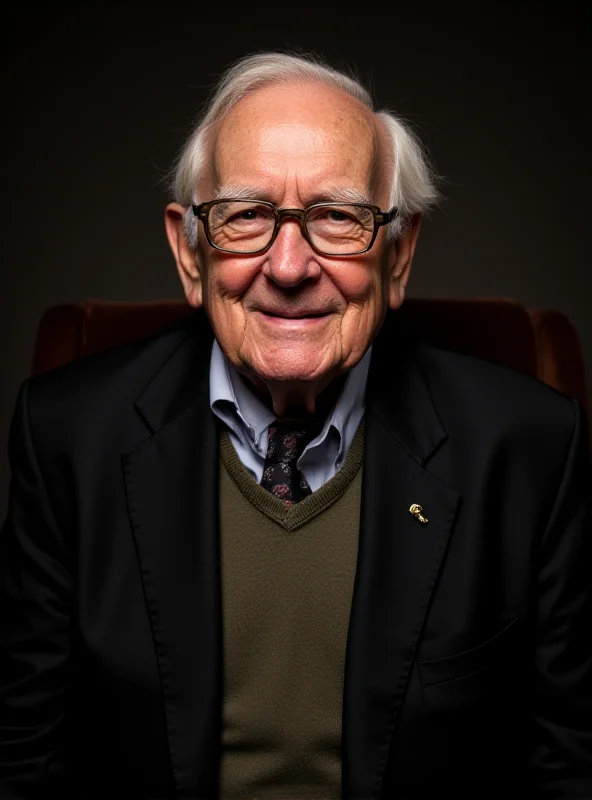

The world of finance is changing. For decades, legendary investors like Warren Buffett have dominated the stock market, relying on experience, intuition, and a deep understanding of the business world. But a new force is emerging: algorithms.

Increasingly, financial managers are turning to automated systems for buy and sell recommendations. These machines process vast amounts of data, far more than any human could analyze, to identify potential opportunities and risks. This trend begs the question: will the next Warren Buffett be human, or a sophisticated piece of code?

The Rise of Automated Investing

The shift towards automation is undeniable. Managers are no longer solely relying on traditional methods; they're leveraging the power of machines to gain an edge in the market. These algorithms analyze everything from market trends to news articles, providing data-driven insights that can inform investment decisions. As one expert noted, "We're seeing a fundamental transformation in how investment strategies are developed and executed."

This doesn't necessarily mean that human investors are becoming obsolete. Instead, it suggests a collaborative future where humans and algorithms work together. Humans can provide the critical thinking and contextual understanding, while algorithms handle the heavy lifting of data analysis.

Buffett's Legacy and the Future of Berkshire Hathaway

While the rise of algorithms may seem like a distant threat to the traditional investment model, even Warren Buffett is preparing for the future. After a remarkable 60-year reign at Berkshire Hathaway, Buffett is taking steps to ensure the company's continued success after his departure.

Buffett has warned shareholders that his time is limited, and he's actively promoting his chosen successor. He's also implemented measures to protect Berkshire Hathaway's legacy and ensure its stability in the years to come. This forward-thinking approach highlights the importance of adapting to change, even for the most successful investors.

A New Era of Investment?

The increasing reliance on algorithms in the stock market raises important questions about the future of investing. Will machines eventually replace human fund managers entirely? Will algorithms create a more efficient and equitable market, or will they exacerbate existing inequalities? Only time will tell. However, it's clear that the world of finance is entering a new era, one where algorithms play an increasingly important role.

As Warren Buffett himself prepares to pass the torch, the investment world is poised for a significant shift. Whether the next great investor is human or machine, one thing is certain: the future of finance will be shaped by the interplay between human intelligence and artificial intelligence.

"It's a brave new world in finance. The question is, can humans keep up?" - Anonymous Financial Analyst