In a significant move reshaping global trade dynamics, BlackRock has agreed to purchase the Panama Canal ports from Chinese conglomerate CK Hutchison for a staggering $22.8 billion. The deal, which also includes stakes in other global ports, sent CK Hutchison's stock soaring by 25%. This acquisition comes as China is simultaneously ramping up economic stimulus measures to safeguard its economy against what Premier Li Qiang calls "changes unseen in a century."

BlackRock's Strategic Play

BlackRock's purchase of the Panama Canal ports from CK Hutchison marks a significant expansion of its global infrastructure portfolio. While both companies insist that the transaction is not a direct result of pressure from former U.S. President Trump, many analysts believe it will contribute to easing geopolitical tensions. CK Hutchison will offload a 90% stake in its subsidiary, Panama Ports Company, along with other non-Chinese ports, to the BlackRock-led group.

The Panama Canal is a vital artery of global trade, connecting the Atlantic and Pacific Oceans. Control over key port infrastructure in the region gives BlackRock a considerable advantage in influencing trade routes and supply chains. The investment firm is clearly betting on the continued importance of the Panama Canal in the global economy.

China's Economic Response

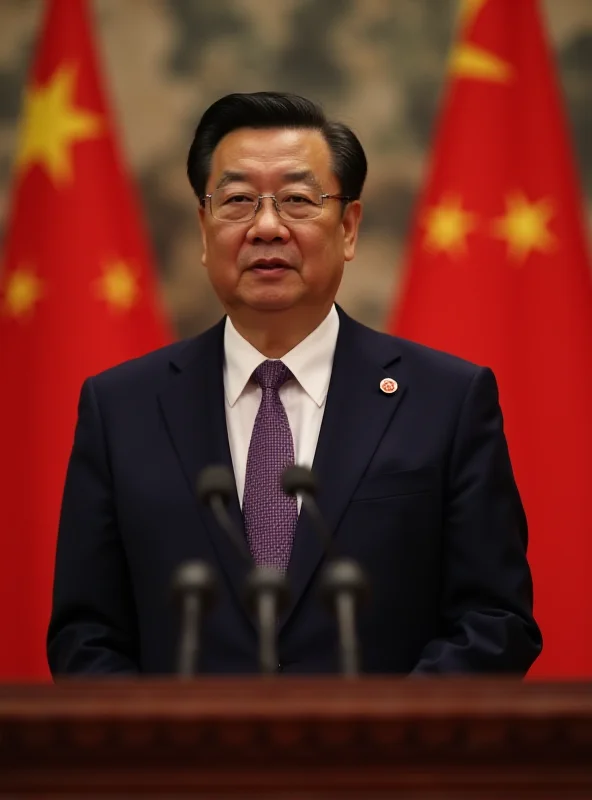

Meanwhile, across the globe, China is taking proactive steps to bolster its economy in the face of mounting external challenges. Premier Li Qiang has emphasized that an increasingly complex and severe external environment may exert a greater impact on China, particularly in sectors like trade, science, and technology.

The stimulus measures are designed to mitigate the potential negative effects of these external pressures and ensure continued economic growth. The exact details of the stimulus package have not been fully disclosed, but it is expected to include measures to boost domestic demand, support key industries, and promote innovation.

Geopolitical Implications

The BlackRock-CK Hutchison deal and China's economic stimulus are occurring against a backdrop of heightened geopolitical uncertainty. As one article noted, the CK Hutchison sale is “expected to help ease geopolitical tensions.” The combined effect of these developments suggests a shifting landscape in global trade and investment.

Palantir, the data analysis and surveillance company sometimes referred to as "Trump's Big Brother," continues to thrive on Wall Street, fueled by its AI-driven solutions for defense and national security. This illustrates the growing importance of technology and data in shaping geopolitical strategies.

The coming months will reveal the full impact of these developments on the global economy and the evolving balance of power.