Brussels is making some interesting moves when it comes to its ambitious green agenda. On one hand, the European Commission is reportedly considering easing up on the controls and penalties for companies that fall short of environmental targets. On the other hand, they're pushing forward with plans to revitalize European industry through clean energy initiatives and hefty financial investments.

Easing the Pressure?

The proposed relaxation of controls and penalties comes as part of a broader legislative package aimed at bureaucratic simplification. This could be seen as a way to encourage businesses to participate in the green transition without the fear of crippling fines or overly strict regulations. It's a delicate balancing act between incentivizing change and enforcing compliance.

A €100 Billion Green Bank

However, the Commission isn't just easing up; they're also doubling down on investment. The plan to create a bank with €100 billion in capital is a significant step towards accelerating the green agenda and financing the decarbonization of European industry. This dedicated funding could provide crucial support for companies looking to adopt sustainable practices and technologies.

“This new bank could be a game-changer for the European economy,” says one industry analyst. “It would provide the necessary capital to drive innovation and help businesses make the transition to a low-carbon future.”

Lowering Electricity Costs

Adding another layer to the green agenda, Brussels is also urging governments to remove up to €14.4 billion in taxes and regulated costs from electricity bills. The European Commission is requesting the twenty-seven for 'a more favorable fiscal framework' for electricity and to remove from the bill the charges that finance non-energy policies. This would not only make electricity more affordable for consumers but also incentivize the adoption of cleaner energy sources.

The Cost of Readiness

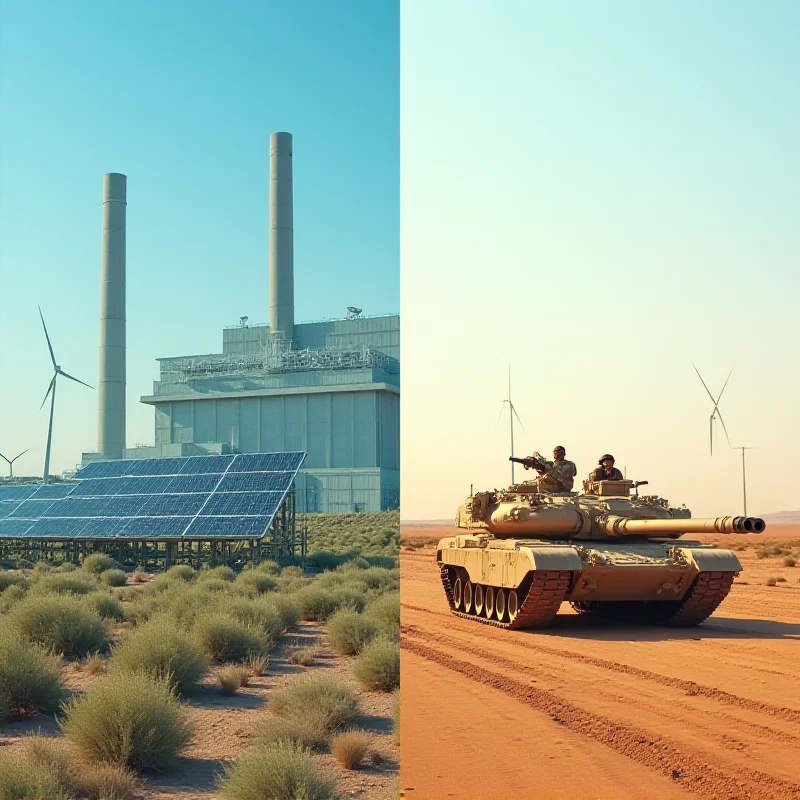

Interestingly, amidst these discussions on green initiatives, a recent IFW study suggests that countries can only achieve true "war-readiness" through increased debt. This adds another dimension to the financial debates in Brussels and Berlin, highlighting the tension between investing in defense and pursuing other crucial policy goals, like environmental sustainability.

The historical comparison to Great Britain's vulnerability against Nazi Germany underscores the importance of adequate defense spending. This perspective creates a complex financial landscape where decisions about green initiatives, economic growth, and national security are intertwined.

Ultimately, Brussels is navigating a complex web of priorities. Balancing environmental goals with economic realities and national security concerns requires careful consideration and strategic decision-making. The coming months will reveal how these different initiatives will coalesce and shape the future of Europe.