Planning for retirement can feel overwhelming. There are so many factors to consider, from how much to save to where to invest. But with the right strategies, you can build a secure and fulfilling retirement.

Diversifying Your Retirement Income

Millions of older Americans rely on Social Security benefits, but experts agree it shouldn't be your *only* source of income. A 2020 report by the National Institute on Retirement Security revealed that only 7% of retirees have an ideal mix of Social Security, savings, and a pension. A concerning 40% rely solely on Social Security. Relying on just one source of income can leave you vulnerable to unexpected financial challenges.

Consider supplementing Social Security with personal savings, investments, and potentially a pension if available. This diversification provides a safety net and increases your financial flexibility in retirement.

The FIRE Movement: Proceed with Caution

The Financial Independence, Retire Early (FIRE) movement promises early retirement through aggressive saving and investing. While the idea of retiring in your 40s or 50s is appealing, it's crucial to understand the potential downsides.

FIRE often requires extreme frugality and a high savings rate, sometimes exceeding 50% of your income. This lifestyle may not be sustainable or desirable for everyone. Furthermore, unexpected expenses, healthcare costs, or market downturns can derail your early retirement plans. It's wise to consider these factors before fully committing to the FIRE lifestyle.

"Few would argue with the appeal of a longer retirement, but before you go down that road, it's important to understand what you're signing up for."

Investing for the Long Term

Building a substantial retirement portfolio requires strategic investing. Dividend-paying value stocks and exchange-traded funds (ETFs) can be excellent options for long-term growth and income.

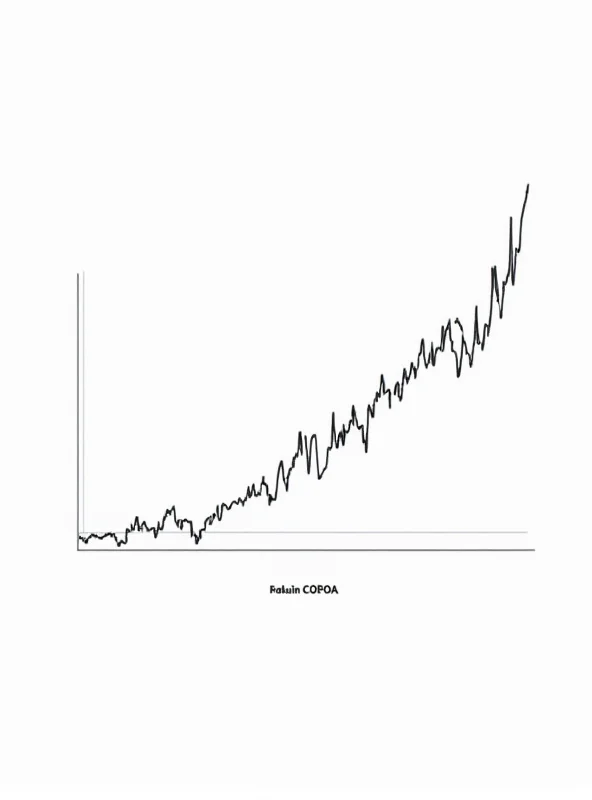

Dividend stocks, like American Electric Power (NASDAQ: AEP), Owens Corning (NYSE: OC), and ConocoPhillips (NYSE: COP), provide consistent income regardless of market fluctuations. Value stocks are priced based on their current earnings, making them potentially undervalued opportunities. Furthermore, ETFs like the Vanguard S&P 500 ETF (VOO) offer diversification and exposure to a broad market index. Hypothetically, consistent investment in VOO could potentially allow investors to reach a million dollar portfolio by 2035.

Remember that all investments carry risk, and past performance is not indicative of future results. Consult with a financial advisor to determine the best investment strategy for your individual circumstances.

Ultimately, a secure retirement requires careful planning, diversification, and a realistic understanding of your financial needs and goals. By considering these strategies, you can increase your chances of enjoying a comfortable and fulfilling retirement.