Coca-Cola, the ubiquitous beverage giant, continues to be seen as a sound and evergreen investment. Its stock is projected to maintain a positive trajectory over the next five years, offering stability in a volatile market. But alongside this positive outlook, concerns are emerging regarding the sourcing of a key ingredient.

The Sweet Side: Coca-Cola as an Investment

For investors seeking long-term, reliable growth, Coca-Cola often appears on the list. The company's strong brand recognition, global reach, and consistent profitability make it a compelling choice. While market conditions can fluctuate, Coca-Cola's proven track record suggests it will remain a stable and rewarding investment in the years to come.

Experts highlight the company's ability to adapt to changing consumer preferences and its commitment to innovation as key factors in its continued success. This proactive approach helps ensure that Coca-Cola remains relevant and competitive in the ever-evolving beverage industry.

The Bitter Truth: Gum Arabic Trafficking

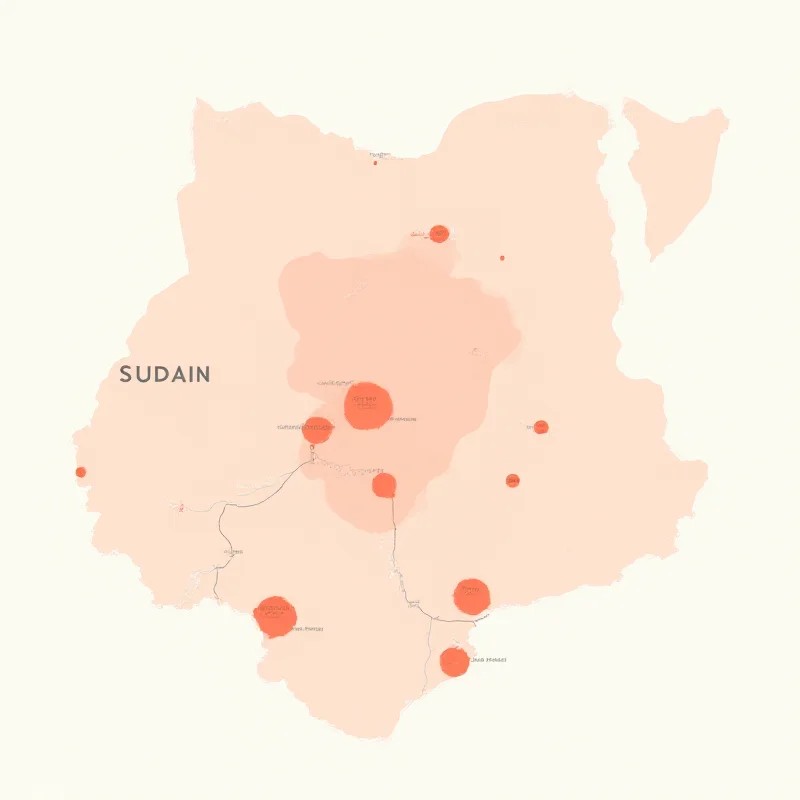

However, a darker side to the story involves gum arabic, a vital ingredient used not only in Coca-Cola but also in a wide range of products, including M&M's. Reports indicate that this essential ingredient is increasingly being trafficked from rebel-held areas of war-torn Sudan.

Traders and industry sources reveal that the illicit trade of gum arabic raises concerns about supply chain security and ethical sourcing. The instability in Sudan, coupled with the involvement of rebel groups, creates a complex and challenging situation for companies that rely on this ingredient.

What Does This Mean for Coca-Cola?

The trafficking of gum arabic poses potential risks to Coca-Cola and other companies that utilize it. Supply disruptions, price fluctuations, and reputational damage are all possible consequences. Consumers are increasingly aware of the ethical implications of their purchasing decisions, and companies must demonstrate a commitment to responsible sourcing.

While Coca-Cola remains a promising investment, the company must address the challenges associated with gum arabic sourcing to maintain its long-term sustainability and protect its brand image. The situation in Sudan requires careful monitoring and proactive measures to ensure a secure and ethical supply chain.

“Companies need to be vigilant and ensure their supply chains are not contributing to conflict or human rights abuses,” says one industry analyst. This statement underscores the importance of due diligence and transparency in the global marketplace.