Costco (NASDAQ: COST) is set to release its Q2 earnings report this week, and investors are buzzing with anticipation. The warehouse club giant has been a consistent performer, leading to speculation about potential moves that could further boost its stock. Will we see a stock split, a special dividend, or a hike in membership fees?

A Potential Stock Split

One of the most talked-about possibilities is a stock split. A stock split would make shares more accessible to a wider range of investors, potentially increasing demand and driving the price even higher. Given Costco's impressive track record, it's a move that many believe is overdue.

The Dividend Discussion

Another factor on investors' minds is the possibility of a special dividend. With strong earnings and revenue growth, Costco might choose to reward shareholders with a one-time payout. This would not only be a welcome bonus for investors but also signal confidence in the company's financial health.

Membership Fee Hike on the Horizon?

Costco's membership model is a key driver of its success. The company typically raises membership fees every few years, and some analysts believe that another increase is on the cards. A fee hike could further boost revenue, although it could also risk alienating some customers. However, Costco's loyal customer base suggests that most members would likely absorb a small increase.

Costco Wholesale recently reported a significant 9.1% surge in sales, fueled by rising revenue and robust e-commerce performance. While operating expenses continue to present a challenge, the company's overall financial picture remains strong.

Why I'm Holding Costco

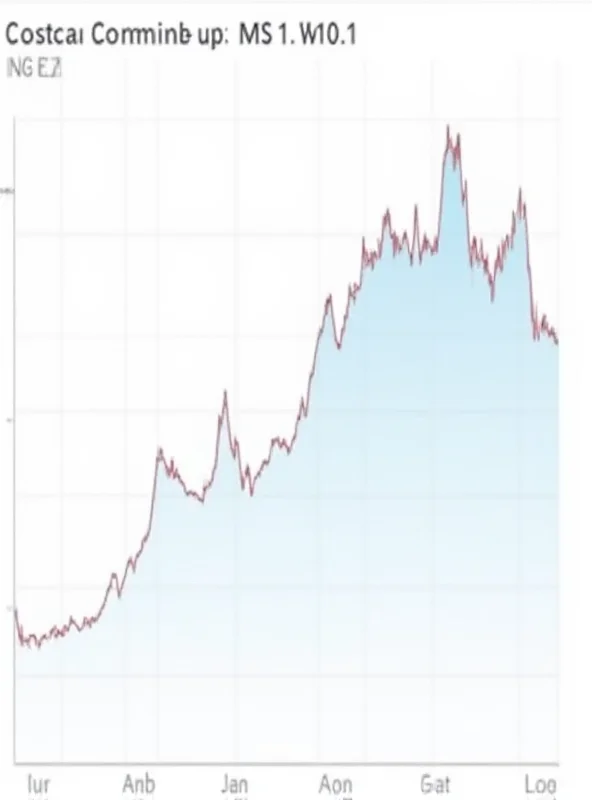

Costco Wholesale (NASDAQ: COST) has consistently outperformed the S&P 500. As one investor noted, "Over the past five years, Costco's stock performance has outpaced the S&P 500 by nearly 150 percentage points." This impressive performance, even with a premium valuation, makes Costco a compelling long-term investment.

Thursday's financial update will be crucial. Investors will be watching closely to see if Costco announces any of these potential initiatives and how the market reacts.