The world of cryptocurrency is constantly evolving, with new opportunities and platforms emerging at a rapid pace. From diversified mining operations to innovative trading solutions, the digital asset landscape is becoming increasingly complex and accessible.

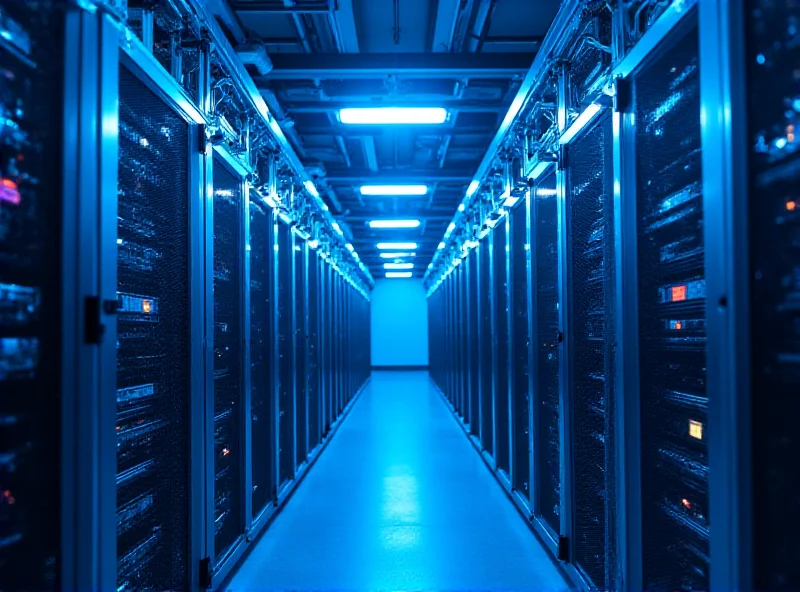

Hut 8's Diversified Approach to Crypto Mining

Hut 8, a name already well-known in the crypto mining space, isn't content with just Bitcoin. This fast-growing company is strategically expanding its operations into other areas of cryptocurrency mining, positioning itself as a versatile player in the market. This move is designed to capitalize on the broader spectrum of digital currencies and ensure sustainable growth in a dynamic industry.

“We believe that diversification is key to long-term success in the crypto market,” says a spokesperson for Hut 8. “By investing in various mining technologies and strategies, we’re building a more resilient and adaptable business.”

This strategic diversification is aimed at harnessing opportunities across the broader spectrum of digital currencies, thereby ensuring sustainable growth and resilience in an ever-evolving industry.

AI-Powered Trading Platforms: Bitcoin +6A Bumex and Bitcoin Apex

Beyond mining, the trading landscape is also seeing significant innovation. Platforms like Bitcoin +6A Bumex and Bitcoin Apex are leveraging the power of artificial intelligence and automation to provide users with a seamless and efficient trading experience. Designed to cater to both novice and expert traders, these platforms offer cutting-edge tools and user-friendly interfaces.

Bitcoin +6A Bumex boasts "cutting-edge AI-powered trading" and "seamless automated tools," while Bitcoin Apex emphasizes its fusion of "advanced AI and user-friendly automations." Both platforms aim to revolutionize the trading journey by simplifying complex processes and providing data-driven insights.

Bitcoin as Part of a Diversified Investment Portfolio

Even in the broader investment world, Bitcoin is gaining traction as a legitimate asset class. A recent podcast episode, celebrating its 200th installment, delved into the optimal investment mix, including stocks, interest rates, rental properties, and Bitcoin. The discussion highlighted key considerations for making capital investments and the importance of diversification.

The episode emphasized that Bitcoin, while potentially volatile, can play a valuable role in a well-rounded portfolio. The key is to understand the risks and rewards and to allocate capital accordingly. The podcast highlighted the importance of considering factors such as risk tolerance, investment goals, and time horizon when making investment decisions.

The cryptocurrency market continues to evolve, offering a range of opportunities for investors and traders. Whether it's through diversified mining operations or innovative trading platforms, the digital asset space is becoming more accessible and sophisticated. As always, it's crucial to conduct thorough research and understand the risks involved before making any investment decisions.