Disney is reportedly planning to reduce its workforce by approximately 6%, resulting in the layoff of 200 employees at ABC News Group and Disney Entertainment Networks. This decision comes as the entertainment giant grapples with a significant decline in television viewership.

Disney's Restructuring

The layoffs are part of a broader effort by Disney to restructure its operations and adapt to the changing media landscape. With more viewers shifting to streaming platforms and other forms of digital entertainment, traditional television networks are facing increasing pressure.

“The media landscape is evolving rapidly,” said one industry analyst. “Companies like Disney need to make tough decisions to remain competitive.”

The news of the job cuts comes as Disney continues to invest heavily in its streaming service, Disney+, in an effort to attract and retain subscribers. The company is also exploring new ways to monetize its content and engage with audiences across multiple platforms.

Other Market Movements

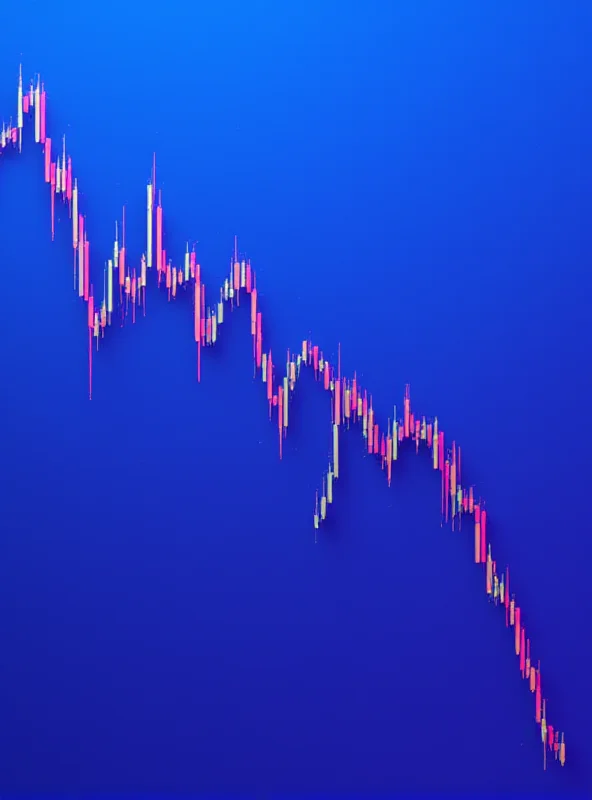

Beyond Disney, several other companies experienced notable stock market activity this week. EQB Inc. (OTCMKTS:EQGPF) saw its shares fall by 4.1% during mid-day trading. The stock traded as low as $67.02 before settling at $67.11. Trading volume was up 29% compared to the average.

Phoenix Group Holdings plc (OTCMKTS:PNXGF) shares, on the other hand, traded up 3.4%. The stock reached a high of $6.36, though trading volume was down significantly, by 89% from the average.

Rupert Resources Ltd. (OTCMKTS:RUPRF) experienced a 1.5% decline in its share price, with the stock trading as low as $3.08. Trading volume was also down, decreasing by 71% from the average daily volume.

Analyst Ratings

In other news, StockNews.com downgraded Cencora (NYSE:COR) from a "buy" rating to a "hold" rating in a research note published on Tuesday. Meanwhile, Barclays boosted their target price on Cencora from $263.00 to $290.00 and gave the stock an “overweight” rating.

These various market movements highlight the dynamic and often unpredictable nature of the current economic climate. Investors are advised to carefully consider their investment strategies in light of these developments.