The economic landscape is shifting as consumers, homebuyers, and small business owners face a complex array of challenges. From calls for economic boycotts to the intricacies of navigating student loan repayments and the hurdles of first-time homeownership, individuals and businesses alike are adapting to a rapidly changing environment.

Economic Blackouts and Consumer Activism

A new wave of consumer activism is emerging, with movements like the People's Union USA urging consumers to participate in "Economic Blackouts." These boycotts call for individuals to abstain from purchasing from major retailers or using specific services for a set period. One such initiative encouraged consumers to boycott Amazon purchases, Prime Video, Whole Foods, Twitch, Ring, and Alexa for an entire week. Similarly, a viral social media movement called for a 24-hour boycott of major retailers on February 28. The goal? To demonstrate consumer power and influence corporate practices.

These "Economic Blackouts" represent a growing trend of consumers using their purchasing power to advocate for change. Whether it's targeting specific companies or a broader call for economic responsibility, these movements highlight the potential impact of collective action.

Navigating the Housing Market and Student Loans

For first-time homebuyers, the dream of owning a home remains a challenge, despite some easing of conditions. While fourth-quarter data revealed an increase in listings and a decrease in prices, affordability continues to be a significant hurdle. The market is shifting, but prospective buyers still need to carefully consider their financial situations.

Student loan borrowers are also facing uncertainty. The shutdown of income-driven repayment applications has left many in the dark, particularly those with upcoming recertification deadlines, those in need of lower monthly payments, those eligible for Public Service Loan Forgiveness (PSLF), and recent graduates. Borrowers are advised to seek guidance and explore alternative repayment options.

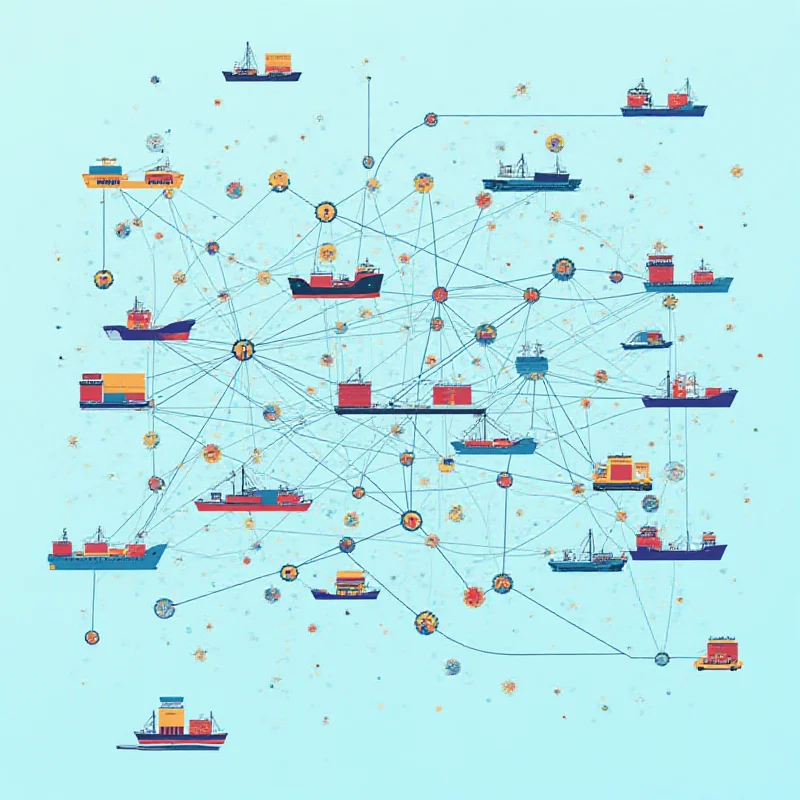

Small Businesses and Supply Chain Risks

Small businesses are also navigating a complex landscape, particularly when it comes to supply chain risks. With ongoing tariff policies, businesses need to take proactive steps to mitigate potential impacts on their bottom line. Strategies include diversifying suppliers, optimizing inventory management, and exploring alternative sourcing options.

“Small business owners need to be proactive in managing their supply chains,” says financial analyst, John Davis. “Understanding the risks and developing contingency plans is crucial for long-term success.”

Even in unexpected circumstances, such as a house being destroyed, financial obligations persist. Your mortgage still exists even if your home is gone, and your mortgage servicer will likely be involved if you decide to rebuild. Understanding these financial realities is crucial for homeowners.

In conclusion, the current economic climate presents a multifaceted set of challenges and opportunities. Whether it's participating in economic boycotts, navigating the complexities of the housing market and student loans, or mitigating supply chain risks, individuals and businesses need to be informed, proactive, and adaptable.