Two important financial deadlines are fast approaching. Gates Group Inc. (GTSG) is preparing to launch its initial public offering (IPO), while former clients of Sberbank CZ are running out of time to claim their insured savings.

Gates Group Inc. Eyes $6 Million IPO

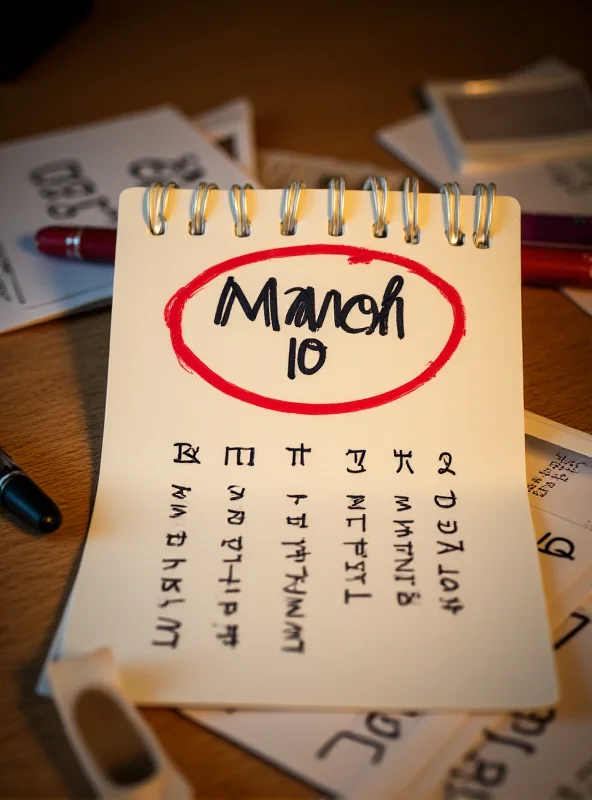

Gates Group Inc. (GTSG) is set to raise $6 million through an IPO, according to IPO Scoop. The offering is planned for the week of March 10th and will involve the issuance of 1,000,000 shares priced at $6.00 each. The company's financial performance over the past year has been notable, with revenues reaching $126.7 million.

While the revenue figure is impressive, it's worth noting that Gates Group Inc. also experienced a net loss during the same period. Investors will likely be scrutinizing the company's financials closely as the IPO date approaches.

Sberbank CZ: Time Runs Out for Claimants

On a different note, former clients of Sberbank CZ are facing a crucial deadline. Nearly three years after the bank's collapse, a significant amount of insured savings remains unclaimed. A staggering 218 million Czech crowns are still waiting to be collected by over 30,000 individuals.

The deadline for claiming these funds is March 10th. After this date, the opportunity to recover these savings will be lost. This represents a significant sum of money for many individuals, and it's crucial that those eligible take action before the deadline.

A Race Against Time

For former Sberbank CZ clients, the message is clear: time is of the essence. Contact the appropriate authorities or financial institutions to initiate the claim process. Don't miss the chance to reclaim what is rightfully yours. As for Gates Group Inc., the market will be watching closely to see how its IPO performs and whether it can translate its revenue into profitability.

"The deadline for claiming these funds is March 10th. After this date, the opportunity to recover these savings will be lost."

These two separate financial events highlight the diverse landscape of the business world, from the excitement of a new IPO to the urgency of recovering lost savings.