In recent business news, Georgia has been making significant strides in international trade and investment. The nation is prioritizing the development of the Middle Corridor, a crucial trade route, and forging stronger customs ties with Turkmenistan. Meanwhile, in the financial sector, notable investment firms are adjusting their holdings in JPMorgan Chase & Co.

Georgia Focuses on Middle Corridor Development

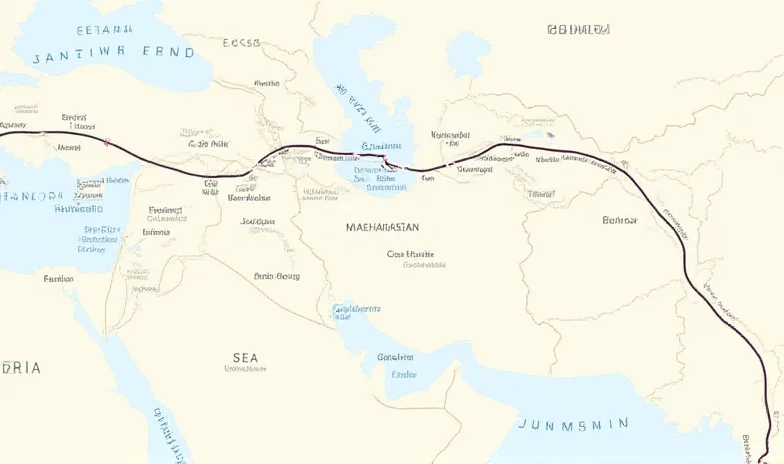

Georgia's Prime Minister has emphasized the country's commitment to developing the Middle Corridor. This strategic initiative aims to enhance trade efficiency and connectivity between Asia and Europe. The Middle Corridor offers a vital alternative to traditional routes, reducing transit times and costs for businesses. Georgia's investment in this project underscores its ambition to become a key player in global trade logistics.

Adding to this momentum, Georgia and Turkmenistan have recently signed a new agreement to strengthen their customs cooperation. "This deal is expected to streamline customs processes, enhance trade efficiency, and boost economic interaction between the two countries," a government spokesperson stated. The initiative signals a forward-looking approach to modernizing customs procedures and fostering stronger bilateral trade relations.

Investment Firms Adjust JPMorgan Chase Holdings

In other news, Avalon Capital Management has reduced its stake in JPMorgan Chase & Co. (NYSE:JPM) by 9.4% during the fourth quarter. According to a report by Holdings Channel, the institutional investor sold 157 shares, leaving them with 1,516 shares valued at approximately $363,000. This adjustment reflects Avalon Capital Management's ongoing portfolio management strategy.

Similarly, Vaughan David Investments LLC IL also decreased its holdings in JPMorgan Chase & Co. The firm reduced its stake by 1.4% during the same quarter, selling 5,262 shares. This adjustment, as detailed in their latest 13F filing with the SEC, leaves Vaughan David Investments with 360,868 shares of the financial services provider's stock.

These adjustments in JPMorgan Chase holdings by Avalon Capital and Vaughan David Investments are part of the normal ebb and flow of institutional investment. It remains to be seen how these shifts will affect the overall performance of JPMorgan Chase & Co. in the long term.

In conclusion, Georgia's strategic focus on trade development, particularly through the Middle Corridor and its strengthened customs ties with Turkmenistan, highlights its growing role in international commerce. Meanwhile, adjustments in investment positions by firms like Avalon Capital and Vaughan David Investments in major companies like JPMorgan Chase reflect the dynamic nature of the financial markets.