The global financial landscape is currently a dynamic and ever-shifting terrain, marked by a confluence of factors ranging from rising borrowing costs to significant labor actions and international financial agreements. Here's a breakdown of some key developments.

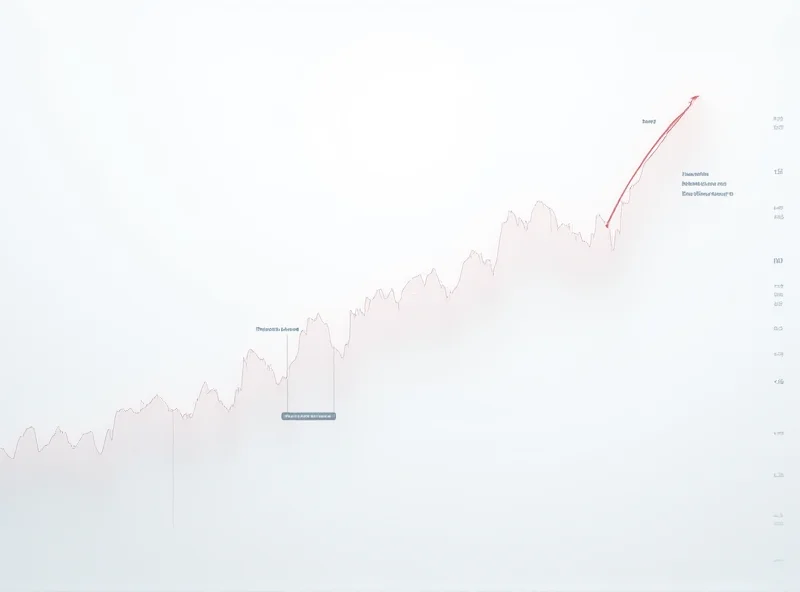

Japanese Bond Yields Soar

Japanese bond yields have surged to a 16-year high, reflecting a global sell-off initially triggered by events in Germany. This increase in borrowing costs highlights the interconnectedness of international financial markets and the ripple effects of economic activity in one region on others. Investors are closely watching how the Bank of Japan will respond to these rising yields and the potential impact on the Japanese economy.

Germany's Economic Landscape: Wealth and Disruptions

Germany, a powerhouse of the European economy, is experiencing both immense wealth accumulation and significant disruptions. The country's richest man has amassed an impressive 8.5 billion in dividends, controlling a substantial portion of the German transportation sector. He himself has admitted the accumulated values are "almost terrifyingly high." This concentration of wealth raises questions about economic inequality and the distribution of resources within the nation.

Meanwhile, major German airports are bracing for a 24-hour strike on Monday, as trade unions and employers remain deadlocked over wage negotiations. Unions walked away from pay talks after employers deemed an 8% raise unaffordable. This strike is expected to cause significant travel disruptions and further strain on the German economy.

Regulatory Scrutiny and International Deals

In other German financial news, the proposed acquisition of Commerzbank by Italian banking giant Unicredit is facing increased scrutiny from Bafin, the German financial regulatory authority. IHK President Ulrich Caspar has urged Bafin to take a closer look at the transactions, raising questions about their legality. The outcome of this regulatory review could have significant implications for the European banking sector.

On the international stage, Sri Lanka has signed a US$2.5 billion debt deal with Japan. The Japanese foreign ministry has stated that Tokyo intends to further contribute to the sustainable development of Sri Lanka. This deal underscores the ongoing economic relationship between the two countries and Japan's commitment to supporting Sri Lanka's growth.

These developments highlight the complex interplay of factors shaping the global financial landscape. From rising bond yields to labor disputes and international agreements, businesses and investors must navigate a constantly evolving environment.

Stay tuned for further updates as these stories develop.