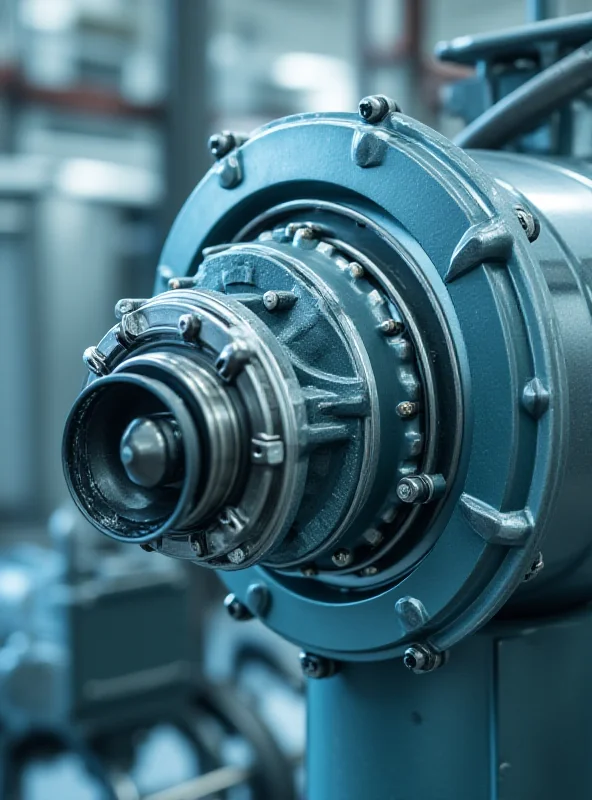

Honeywell (NASDAQ: HON), a $130 billion industrial giant, is making moves to strengthen its position in the energy sector. The company recently announced the acquisition of a pump-maker business from Sundyne in a deal valued at a substantial $2 billion. This strategic acquisition will be incorporated into Honeywell's Energy and Sustainability Solutions (ESS) unit, enhancing its energy security offerings.

A Strategic Acquisition for Energy Solutions

The acquisition of Sundyne's pump-maker business is a significant step for Honeywell as it seeks to expand its reach in the energy and sustainability market. By integrating this business into its ESS unit, Honeywell aims to provide more comprehensive and robust solutions for its customers. This move aligns with the growing demand for energy security and sustainable technologies.

Honeywell's current operations span a wide range of industries, from automation to aerospace and advanced materials. As an industrial conglomerate, Honeywell faces the challenge of balancing diverse business interests. The company's ability to adapt to changing market dynamics and investor preferences will be crucial for its continued success. "Honeywell is a dynamic company that constantly evaluates its portfolio to maximize value for its shareholders," a company spokesperson stated.

Navigating the Industrial Landscape

The industrial sector is constantly evolving, with trends shifting between consolidation and specialization. Investors sometimes favor companies that grow larger through acquisitions, creating conglomerates. At other times, the preference leans towards companies that slim down and specialize, leading conglomerates to break themselves apart. Honeywell must navigate this complex landscape to maintain its competitive edge.

Looking Ahead: What's Next for Honeywell?

The acquisition of Sundyne's pump-maker business is just one piece of the puzzle for Honeywell. As the company continues to evolve, it will be interesting to see how it adapts to changing investor sentiments and market trends. Will Honeywell continue to expand through acquisitions, or will it consider restructuring its business to focus on core areas? Only time will tell.

"Honeywell's ability to adapt to changing market dynamics will be crucial for its continued success."

Honeywell's future direction will depend on several factors, including the overall economic climate, technological advancements, and the evolving needs of its customers. The company's leadership will need to make strategic decisions to ensure that Honeywell remains a leader in the industrial sector.

In conclusion, Honeywell's acquisition of Sundyne's pump-maker business is a significant move that underscores its commitment to energy security and sustainability. As the company navigates the complexities of the industrial landscape, its ability to adapt and innovate will be key to its long-term success.