International Airlines Group (IAG), the parent company of British Airways and Iberia, is facing a complex situation. On one hand, booming transatlantic ticket sales are driving record profits. On the other, a dispute with pilots at Iberia Express is leading to potential changes in its low-cost strategy. Let's delve into the details.

Transatlantic Boom Fuels Record Profits

IAG has announced impressive financial results for 2024, largely fueled by the surge in transatlantic ticket sales. Post-tax profits edged up to €2.73 billion (£2.26 billion), with operating profits rising by 22% to €4.3 billion (£3.55 billion). This success reflects a significant rebound in passenger numbers following the challenges of the Covid-era collapse, as well as the impact of turnaround investments, particularly within British Airways.

“International Airlines Group says results reflect turnaround investment in BA as passenger numbers rebound,” the company stated, highlighting the positive impact of strategic initiatives.

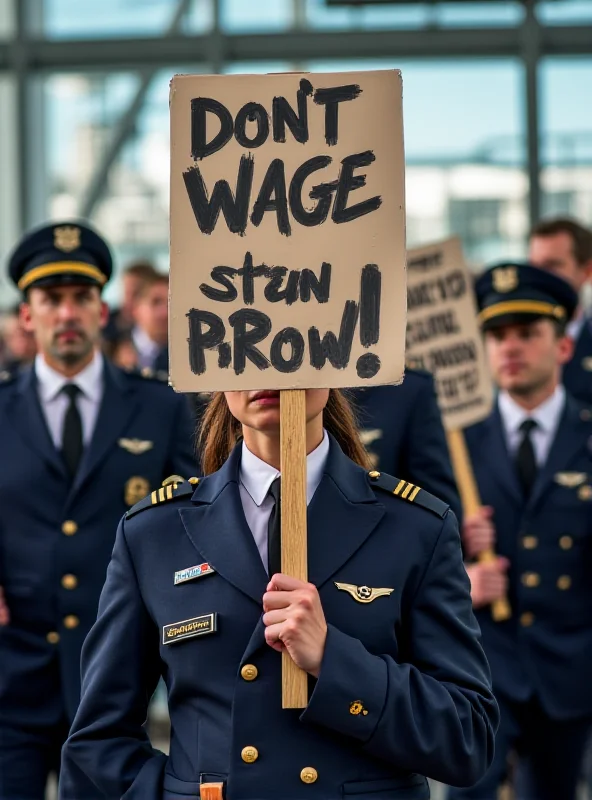

Iberia Express Pilot Dispute

While IAG celebrates its financial success, it is also grappling with a labor dispute involving Iberia Express and the UPPA union. The core issue revolves around salary discrepancies between Iberia Express pilots and those at its parent company, Iberia. IAG has reportedly refused to match the salaries, leading to legal proceedings and escalating tensions.

A New Low-Cost Strategy?

In response to the ongoing conflict, IAG is considering a significant strategic shift: launching a new low-cost airline at Barajas Airport in Madrid while simultaneously freezing operations at Iberia Express. This move is seen as a direct reaction to the legal challenges and the refusal to equalize salaries. The precise details of this new low-cost carrier remain to be seen, but it signals a potential restructuring of IAG's budget airline offerings.

This situation underscores the complexities of managing a large airline group with diverse labor forces and evolving market dynamics. Whether IAG can successfully navigate these challenges and maintain its profitability remains to be seen. Jefferies Financial Group, however, remains optimistic, recently raising its price objective for International Consolidated Airlines Group (LON:IAG) stock from GBX 350 ($4.48) to GBX 400 ($5.12), maintaining a "buy" rating.

The coming months will be crucial for IAG as it seeks to resolve the pilot dispute, implement its low-cost strategy, and capitalize on the continuing demand for transatlantic travel.