The fourth quarter of 2023 saw several investment firms making adjustments to their portfolios. These adjustments, revealed in recent SEC filings, offer a glimpse into the strategies and outlook of these institutions. Let's take a look at some of the key moves made during this period.

Oppenheimer & Co. Inc. Increases Stake in Aon plc

Oppenheimer & Co. Inc. significantly increased its stake in Aon plc (NYSE:AON) during the fourth quarter. According to their most recent disclosure with the Securities and Exchange Commission (SEC), the firm raised its position by a substantial 196.1%. This translates to an acquisition of an additional 1,600 shares, bringing their total holdings to 2,416 shares. Aon plc is a financial services provider.

This move suggests that Oppenheimer & Co. Inc. has a positive outlook on Aon plc and its future performance. The significant increase in their stake reflects a strong belief in the company's value and potential for growth.

Mutual of America Capital Management LLC Reduces Rockwell Automation Holdings

While Oppenheimer & Co. Inc. was increasing its stake in Aon, Mutual of America Capital Management LLC was taking a different approach with Rockwell Automation, Inc. (NYSE:ROK). According to a report by Holdings Channel.com, Mutual of America Capital Management LLC lessened its holdings in Rockwell Automation by 3.2% during the fourth quarter. This involved selling 449 shares, leaving them with a total of 13,527 shares in the industrial products company.

This reduction in holdings could be due to various factors, including a change in investment strategy or a reassessment of Rockwell Automation's prospects. Institutional investors frequently adjust their portfolios based on market conditions and their own internal analyses.

Oppenheimer & Co. Inc. Acquires New Position in Amplify ETF

In addition to increasing its stake in Aon, Oppenheimer & Co. Inc. also made a new investment in Amplify Transformational Data Sharing ETF (NYSEARCA:BLOK) during the fourth quarter. According to their Form 13F filing with the SEC, the institutional investor acquired 17,992 shares of the company’s stock, valued at approximately $777,000. The report also indicated that other institutional investors had recently purchased shares as well.

This move into the Amplify ETF suggests an interest in the transformational data sharing space, potentially reflecting a belief in the growth and potential of blockchain technology and related industries.

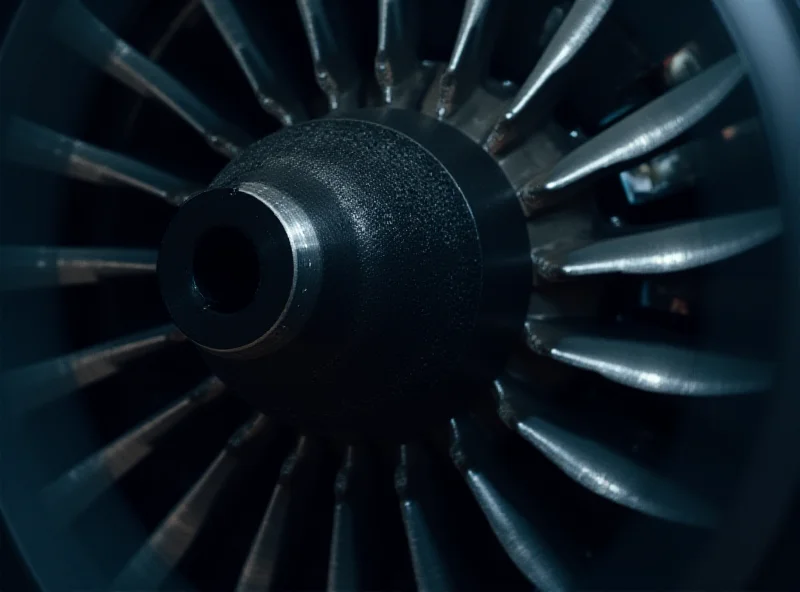

Howmet Aerospace: A "Monster Stock" Outperforming the Market

Beyond the specific moves of these investment firms, it's important to remember that successful investing involves looking beyond the most popular names. One company that has been quietly outperforming the market is Howmet Aerospace (NYSE: HWM). While the S&P 500 has remained relatively flat this year, Howmet's shares have gained approximately 17%. This impressive performance highlights the potential for significant gains in less well-known companies.

The lesson here is clear: diversify, think long-term, and don't be afraid to explore investment opportunities beyond the headlines. Sometimes, the "monster stocks" are the ones you least expect.

These fourth-quarter adjustments provide valuable insights into the strategies of major investment firms and the ever-changing dynamics of the stock market. By paying attention to these trends, investors can make more informed decisions and potentially uncover hidden gems like Howmet Aerospace.