The financial landscape is currently a complex mix of challenges and opportunities. From market sell-offs signaling potential economic downturns to individual companies navigating external pressures, and regulatory battles unfolding in courtrooms, investors and observers alike are closely watching the shifting sands.

Dark Clouds on the Horizon?

Recent market activity suggests a growing unease about the future. A significant market sell-off is raising concerns that the economy may be heading towards a more severe downturn. Some analysts warn that this is a signal of a darker economic storm brewing. It's a "bad to worse" scenario that demands careful consideration and strategic planning for investors.

However, amidst the potential gloom, there are companies demonstrating resilience and innovative strategies for long-term growth.

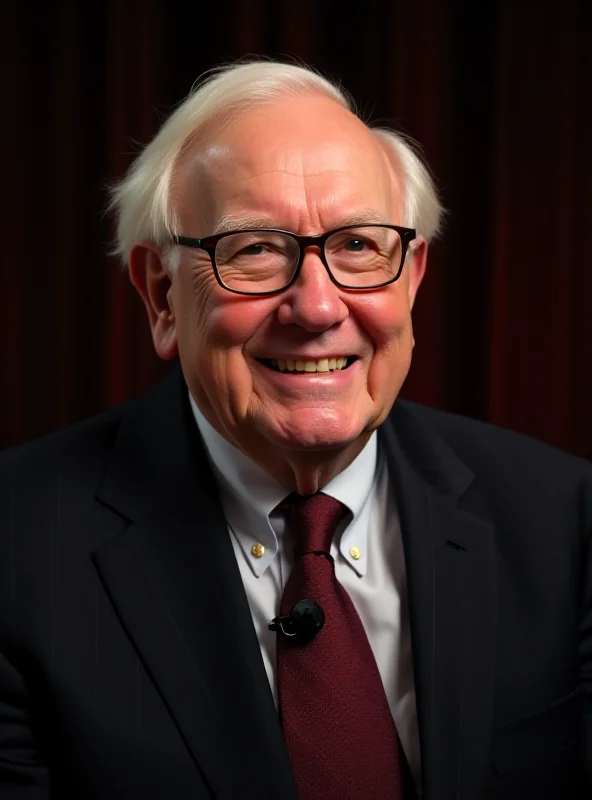

Berkshire Hathaway's Enduring Wisdom

Berkshire Hathaway's annual letter always provides valuable insights into their investment philosophy. This year, the focus is on "triple compounding" – a strategy that emphasizes long-term growth and the power of compounding returns over time. The letter highlights why betting against this strategy, given Berkshire Hathaway's historical performance and sound management, is generally considered unwise. It's a testament to the enduring value of patience and a focus on fundamental strengths.

Warren Buffet famously said,

"Someone's sitting in the shade today because someone planted a tree a long time ago."This quote perfectly encapsulates the long-term thinking behind Berkshire Hathaway's investment approach.

CapitaLand's Independence

CapitaLand Integrated Commercial Trust is another example of a company adapting to a changing world. The trust has focused on reducing its reliance on external economic factors through diversified portfolios and proactive management strategies. This approach aims to enhance stability and performance, making the trust more resilient to market fluctuations. It's a strategy that prioritizes internal strength and adaptability in an uncertain environment.

Staley's Last Stand

On a different front, Jes Staley, the former head of Barclays, is engaged in a legal battle against British regulators. He is contesting their decision to ban him from London's financial district due to his relationship with Jeffrey Epstein. While Staley claims to have severed ties with Epstein, emails suggest a closer personal connection, referring to Epstein as "family" and "uncle." This case highlights the importance of ethical conduct and the scrutiny faced by those in positions of power.

The London Stock Exchange Group is also experiencing changes that impact its operational or financial standing, although details of these changes were not provided. This further underscores the dynamic nature of the business world.

In conclusion, the current financial climate is characterized by both risk and opportunity. From navigating market volatility to understanding the principles of long-term investment and upholding ethical standards, success requires a combination of strategic thinking, adaptability, and a commitment to sound principles.