The current economic landscape presents a mixed bag for investors and individuals planning for retirement. While certain market indicators suggest potential growth, others highlight underlying vulnerabilities and personal financial struggles. Let's delve into some key trends and challenges shaping today's financial climate.

Navigating Market Volatility

Recent market turbulence has put low-volatility Exchange Traded Funds (ETFs) in the spotlight. These ETFs have demonstrated their resilience, offering a buffer against market downturns. "Low-volatility ETFs have delivered on their promise to shine during uncertain times on Wall Street," reports one analysis. For investors seeking stability amidst fluctuating markets, these ETFs can be a valuable tool.

On the other hand, there are also positive indicators suggesting a potential rally. The VIX, a popular measure of market volatility, is currently flashing a "buy signal," and there are increasing signs that the market is oversold. This could potentially propel the S&P 500 above 6,000. However, it's crucial to remember that "oversold rallies can be short-lived," so caution and strategic planning are essential.

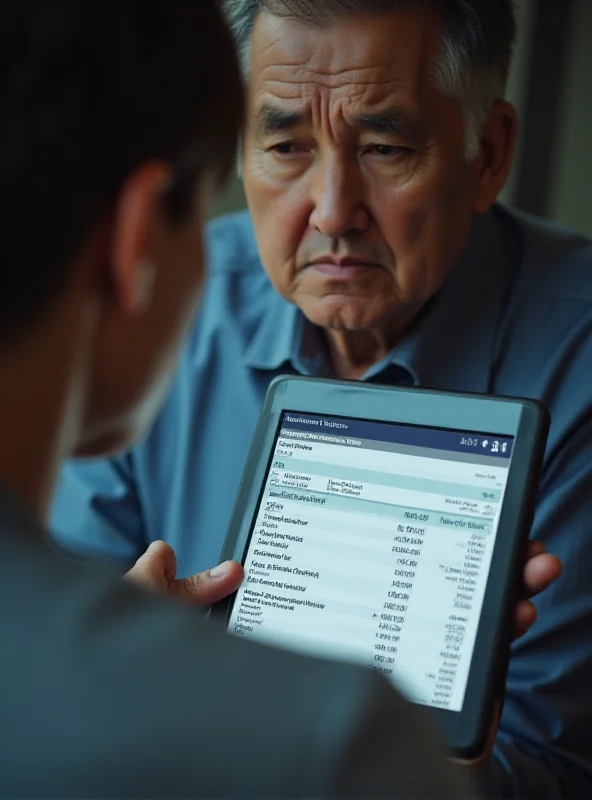

Retirement Savings Shortfall

The dream of a comfortable retirement is becoming increasingly challenging for many. One individual, a 69-year-old who dedicated 45 years to the same company, faces a stark reality with only $121,000 in their 401(k). This highlights a critical issue: the need for diligent financial planning and consistent contributions throughout one's career. The individual plans to continue working and contributing to both a 401(k) and a stock-purchasing plan, demonstrating a proactive approach to addressing the shortfall.

Corporate Restructuring and Competition

Beyond individual financial concerns, the corporate world is also undergoing significant shifts. Hewlett Packard Enterprise (HPE) is implementing a cost-cutting program that will result in approximately 2,500 job cuts, representing a 5% reduction in its workforce over the next 12 to 18 months. This move reflects the pressures companies face to adapt to changing market conditions and maintain profitability.

Meanwhile, in the satellite communications sector, competition is heating up. Shares of Eutelsat, the European rival to Starlink, have tripled, signaling strong investor confidence. The company's CEO has also asserted its ability to operate effectively in Ukraine, further solidifying its position in the market. This development underscores the dynamic nature of the technology industry and the potential for growth even in challenging geopolitical environments.

In conclusion, the current financial landscape presents a complex interplay of opportunities and challenges. From navigating market volatility with low-risk ETFs to addressing retirement savings shortfalls and adapting to corporate restructuring, individuals and businesses must remain informed, proactive, and adaptable to thrive in this ever-evolving environment.