The business world is constantly evolving, with various factors influencing investment decisions and economic trends. This week, we're looking at a few key stories that are shaping the financial landscape, from stock market anxieties to regional growth and the impact of political associations on major companies.

North Carolina: The Next Big Boom State?

Raleigh and Charlotte, North Carolina, are experiencing tremendous growth. Over the past five years, Raleigh's population has surged by 11.53%, while Charlotte's has grown by 8.81%. Compare that to the U.S. average of just 2.94%, and you can see why some experts are calling North Carolina the next big boom state. This rapid growth is creating opportunities in various sectors, particularly in real estate and business development.

“The growth in North Carolina is undeniable,” says one local economist. “We're seeing an influx of talent and investment, which is fueling a vibrant economy.”

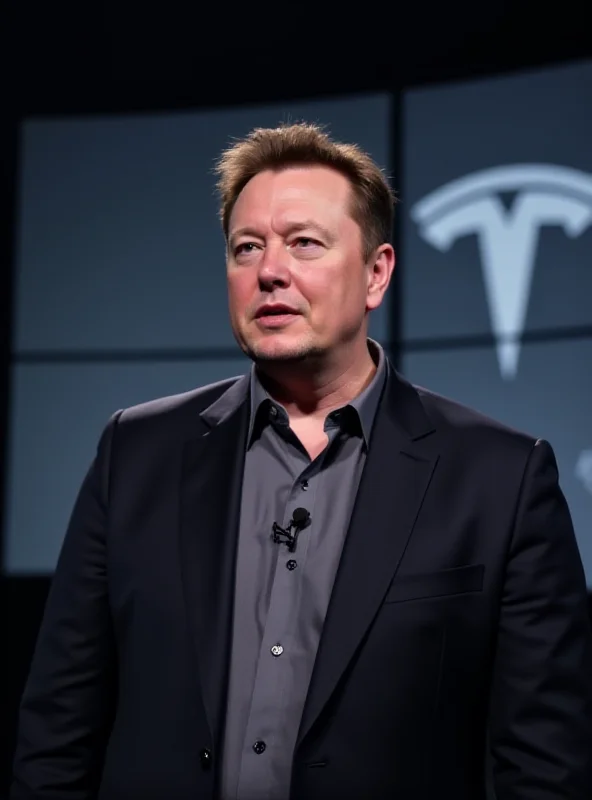

Tesla and the Politics of Perception

Elon Musk's political affiliations are causing quite a stir on Wall Street. Some Tesla investors are worried about Musk's close ties to the U.S. administration, leading to a recent selloff of Tesla stock. However, some analysts believe this reaction is overblown. Wall Street’s biggest Tesla bull argues that investors are becoming too overwrought by concerns over Elon Musk’s close ties to the U.S. administration. Is the market overreacting, or are these concerns justified? Only time will tell.

Navigating a Volatile Stock Market

The stock market has been on a rollercoaster lately. Major indices like the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average have all experienced significant drops. The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average have fallen by 3.92%, 4.44%, and 3.15%, respectively, since Monday. Many Americans are concerned about the impact of tariffs and other economic policies.

In fact, a recent survey by the American Association of Individual Investors revealed that a whopping 57% of U.S. investors have a negative outlook on the market.

Amidst this uncertainty, Private Trust Co. NA recently invested $35,000 in the Vanguard U.S. Quality Factor ETF (BATS:VFQY), buying 251 shares. This move suggests a potential belief in long-term value despite the current market turbulence. Before investing, make sure you’re prepared for further volatility. It's uncertain whether this dip will turn into a full-blown bear market or recession.

These are just a few of the stories impacting the business world right now. Stay informed, stay vigilant, and remember that informed decisions are key to navigating these dynamic times.