The financial markets are currently navigating a complex landscape, facing pressures from potential tariff wars and shifting economic policies. Recent trading sessions have been marked by volatility, with some key indices struggling to maintain their gains. However, amidst this uncertainty, certain companies like Berkshire Hathaway are demonstrating resilience and even achieving new heights.

Tariff Fears and Market Declines

Concerns surrounding potential trade wars, particularly those linked to policies under the Trump administration, have contributed to a decline in market confidence. The dollar has experienced a sharp decline, reflecting investor anxiety over the potential economic impact of increased tariffs. The S&P 500, a key indicator of the overall health of the American stock market, has even erased all post-election gains at one point, signaling the depth of investor unease. This is largely attributed to the threat of trade disputes between the United States and its major trading partners.

“The agreement with Mexico and Canada is a halfway measure towards meeting the country's demands,” noted the U.S. Secretary of Commerce, highlighting the ongoing negotiations and potential for further policy adjustments. This uncertainty continues to weigh heavily on market sentiment.

Berkshire Hathaway's Outperformance

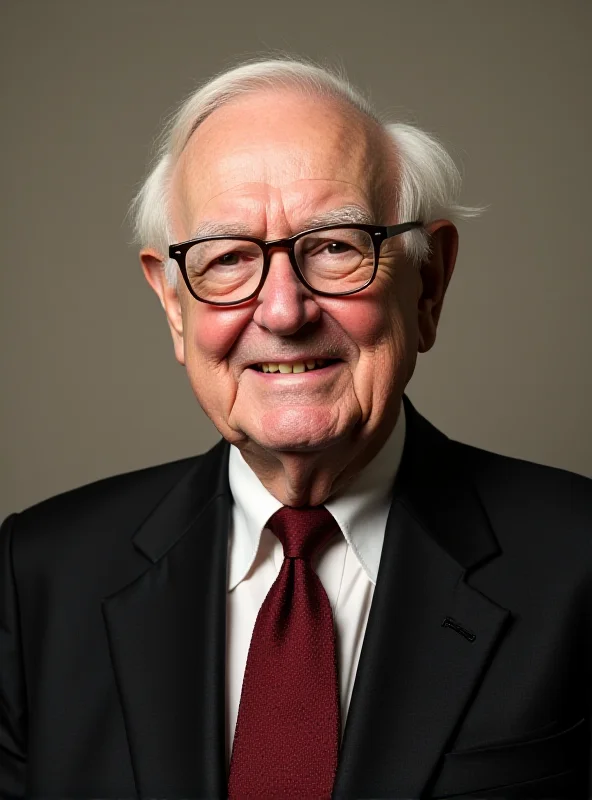

While the broader market faces headwinds, Berkshire Hathaway, led by Warren Buffett, has been a notable exception. The company's B shares recently surpassed $500 for the first time since its 2010 stock split. This milestone is particularly significant given the challenging market conditions. Despite a major down day in the broader indexes, with the Nasdaq Composite falling 2.8% and the S&P 500 slipping 1.6%, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) gained 1.7% on the session and then reached an all-time high on Friday.

Berkshire's strong performance is not a recent phenomenon. It has consistently outperformed the S&P 500, demonstrating a higher total return in both 2024 and 2025. This has propelled the price of Berkshire A shares past $750,000, further solidifying its position as a market leader.

Steel Sector Adjustments

In other market news, Mutual of America Capital Management LLC recently decreased its position in United States Steel Co. (NYSE:X) by 1.6% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 118,944 shares of the basic materials company’s stock after selling 1,971 shares during the quarter. This adjustment reflects ongoing portfolio management decisions within the investment community and highlights the dynamic nature of the stock market.

As market conditions continue to evolve, investors are closely monitoring economic policies, trade negotiations, and individual company performance to navigate the current environment and identify potential opportunities.