The market is a complex beast, influenced by a myriad of factors ranging from geopolitical events to individual company decisions. Recent activity highlights this complexity, with the influence of Donald Trump's policies, the impact of tariffs, and major private equity deals all contributing to the current market landscape. Let's dive into some of the key trends.

The "Trumpcession" and Tariff Impact

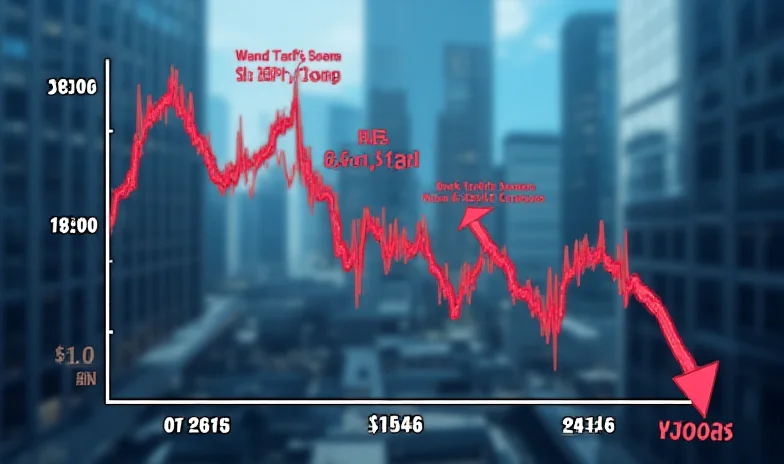

Concerns are growing about a potential "Trumpcession," fueled by the impact of tariffs on the US stock market. Reports indicate that tariffs implemented under Donald Trump have erased significant post-election gains, wiping out an estimated $3.4 trillion in market value. This has led to a noticeable nosedive in US stock performance and increased anxiety among investors.

“The market's reaction to these policies is a clear indicator of the uncertainty surrounding global trade,” says one market analyst. The long-term effects of these tariffs remain to be seen, but the immediate impact has been undeniably negative.

Opportunities in ETFs Amidst Deregulation

Despite the concerns surrounding tariffs, some analysts see opportunities emerging in specific sectors. Exchange-traded funds (ETFs) are gaining traction as a way to access promising areas of the stock market. Well-chosen sector ETFs can offer diversification and focus on lucrative investment themes.

One potential catalyst for growth is the deregulation initiatives pushed by the Trump administration. The belief is that fewer regulations could lead to lower costs for businesses and consumers, ultimately boosting economic growth. If this proves true, the financial industry could be poised for a significant upswing, making certain financial sector ETFs attractive investment options for 2025.

Oil Prices and OPEC's Strategy

The price of oil is another area experiencing significant volatility. The price of North Sea Brent crude oil has fallen back to its levels at the end of 2021. This decline is attributed to an increase in supply from oil-exporting countries, influenced by OPEC's strategy and, notably, the "threats" from Donald Trump, likely referring to pressure on OPEC to increase production.

Major Deals: Walgreens Boots Alliance Goes Private

Beyond market trends, significant corporate deals are also shaping the financial landscape. The US owner of the UK pharmacy chain Boots, Walgreens Boots Alliance, is set to be taken private in a substantial $10 billion deal. The buyer is US private equity firm Sycamore Partners. This move marks the end of nearly a century of trading on public markets for Walgreens Boots Alliance.

The deal comes as Walgreens Boots Alliance faces challenges in the internet era, with customers increasingly turning to online shopping. This acquisition reflects a broader trend of private equity firms targeting established businesses that are undergoing significant transformation in the face of technological disruption.

In conclusion, the current market environment is characterized by volatility and uncertainty. The impact of tariffs, the potential for deregulation, fluctuations in oil prices, and major corporate deals are all contributing factors. Investors need to stay informed and adaptable to navigate these dynamic conditions.