The Near East remains a focal point of global attention, with ongoing tensions and diplomatic efforts seeking resolution. This week has seen developments ranging from ceasefire negotiations to internal investigations regarding security failures. Simultaneously, shifts in taxation laws in France could impact individuals significantly.

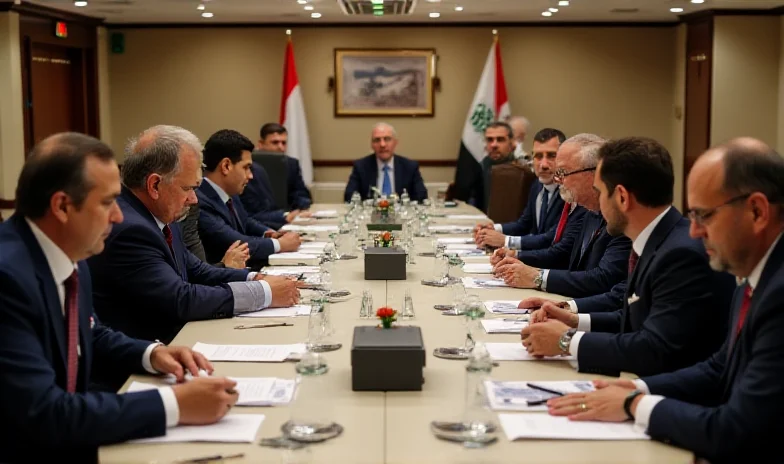

Ceasefire Negotiations in Cairo

Efforts to establish a lasting truce in the Gaza Strip continue, with "intensive discussions" underway in Cairo. Israel has dispatched negotiators following Hamas's handover of the remains of four hostages in exchange for the release of 643 Palestinian prisoners. This exchange marked the conclusion of the first phase of the ceasefire agreement. However, the entry into force of a second phase remains uncertain. The complexities of the situation are evident, with both sides navigating delicate negotiations.

Adding to the volatility, a presumed car-ramming attack in northern Israel resulted in thirteen injuries, including a 17-year-old girl in critical condition. Magen David Adom, Israel's equivalent of the Red Cross, provided on-site treatment. This incident underscores the ongoing security challenges in the region.

Israeli Army Investigates October 7 Fiasco

An internal army investigation into the events surrounding the October 7 attack has revealed significant flaws in the analysis of the threat posed by Hamas. The military hierarchy acknowledges a mistaken perception of the Palestinian Islamist movement, believing it to be primarily focused on managing the Gaza Strip. This misjudgment led to an underestimation of Hamas's capabilities and intentions. The report highlights the importance of accurate threat assessment and preparedness.

In southern Syria, the population is mobilizing against what they perceive as an Israeli project for a 'security zone.' Benyamin Netanyahu's call for "the complete demilitarization (...) in the provinces of Quneitra, Daraa and Sweida" and his assurances of protection for the Druze community have been met with protests. These announcements are viewed by some as an attempt to establish an Israeli-controlled buffer zone.

Tax Changes in France

Beyond the Near East, legislative changes are also making headlines. In France, the 2025 finance law has been enacted after validation by the Constitutional Council. This law introduces key tax measures affecting individuals. While the specifics of these measures are complex, the overarching goal is to adjust the fiscal landscape. Affected individuals should seek professional advice.

"The enacted 2025 finance law brings significant changes to taxation for individuals. Understanding these changes is crucial for financial planning."

These developments across the Near East and in France highlight the complex and interconnected nature of global events, from political negotiations and security concerns to domestic legislative changes.