Tech stocks have been a rollercoaster lately, and two names in particular, Nvidia and Palantir, are making headlines. Nvidia, the AI chip giant, has seen its stock dip despite strong earnings, while Palantir continues its impressive climb. But are these opportunities to buy the dip, or are there warning signs investors should heed?

Nvidia's Post-Earnings Plunge: A Buying Opportunity?

Nvidia (NASDAQ: NVDA) shares experienced a significant drop, with nearly a 9% decline early in the week and over 13% since its latest earnings report. Despite the strong quarterly results and a booming year, the stock is now trading below its levels from six months ago. This has led some to believe it could be an ideal time to invest.

The question is, why the negative sentiment? Is it simply a market correction after a period of rapid growth, or is there something more concerning at play? Some analysts believe this dip presents a chance for investors who missed out on Nvidia's initial surge to get in at a more attractive price.

Insider Activity: A Red Flag?

Adding another layer of complexity, recent reports highlight "insider activity" at both Nvidia and Palantir. What exactly this entails is unclear from the source articles, but the question posed is whether this activity should be considered a warning signal to investors. While it's not uncommon for company insiders to buy or sell shares, unusual patterns can sometimes indicate underlying issues.

It's crucial for investors to do their own research and understand the context of this insider activity. Is it a widespread trend, or isolated incidents? Are there any other factors that might be contributing to the stock's movements?

Palantir: Riding the Wave or Approaching a Peak?

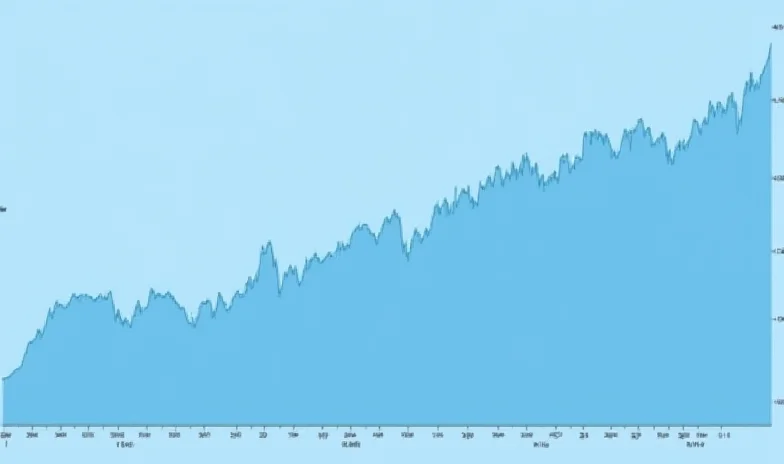

On the other hand, Palantir Technologies (NASDAQ: PLTR) has been on a tear, with shares surging over 350% since the beginning of 2024. The question then becomes: should investors "take the money and run," or hang on for the long haul? Some argue that Palantir's continued growth potential makes it a worthwhile investment, even at its current price. The article suggests that by "letting your winners run," investors can see life-changing returns.

However, market volatility is always a concern. As one article states, "Investing can be hard -- even when you get things right." It requires careful consideration of risk tolerance and a long-term perspective.

NationGate's Denial Amidst Nvidia Fraud Allegations

Adding another twist to the Nvidia narrative, NationGate Holdings Bhd, an electronics services provider based in Penang, has denied any involvement in a Singapore fraud case related to Nvidia. The company's share price has taken a hit, but management insists this is due to market speculation and external pressures, not any internal misconduct. This situation highlights the complex web of relationships within the tech industry and the potential for reputational damage, even in the absence of direct involvement.

Ultimately, the decision to buy, sell, or hold Nvidia and Palantir stock rests with each individual investor. Careful consideration of the factors outlined above, along with thorough research and a clear understanding of one's own investment goals and risk tolerance, are essential for making informed decisions in today's dynamic market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.