The stock market is a dynamic landscape, constantly shifting with investor sentiment, analyst ratings, and company performance. Here's a look at some recent notable activity involving several companies.

Investor Adjustments

Oppenheimer & Co. Inc. recently adjusted its holdings in Starwood Property Trust, Inc. (NYSE:STWD). According to their latest filing with the Securities & Exchange Commission, they lowered their position by 41.5% during the fourth quarter, selling off 35,135 shares. This leaves them with 49,565 shares of the real estate investment trust.

Similarly, Los Angeles Capital Management LLC trimmed its position in Xerox Holdings Co. (NYSE:XRX) by 17.6% in the fourth quarter. Their recent Form 13F filing with the SEC reveals they now own 17,588 shares of the information technology services provider's stock after selling 3,767 shares.

These adjustments reflect ongoing evaluations and strategic decisions made by institutional investors based on various market factors and company-specific performance.

Permian Resources Downgrade

Permian Resources Co. (NYSE:PR) experienced a dip in its stock price, hitting a new 52-week low on Tuesday. This followed an analyst downgrade from Citigroup, who lowered their price target from $18.00 to $17.00. Despite the lower target, Citigroup maintains a "buy" rating on the stock. Permian Resources traded as low as $12.48 during the day.

Fiverr's AI Innovation and Growth

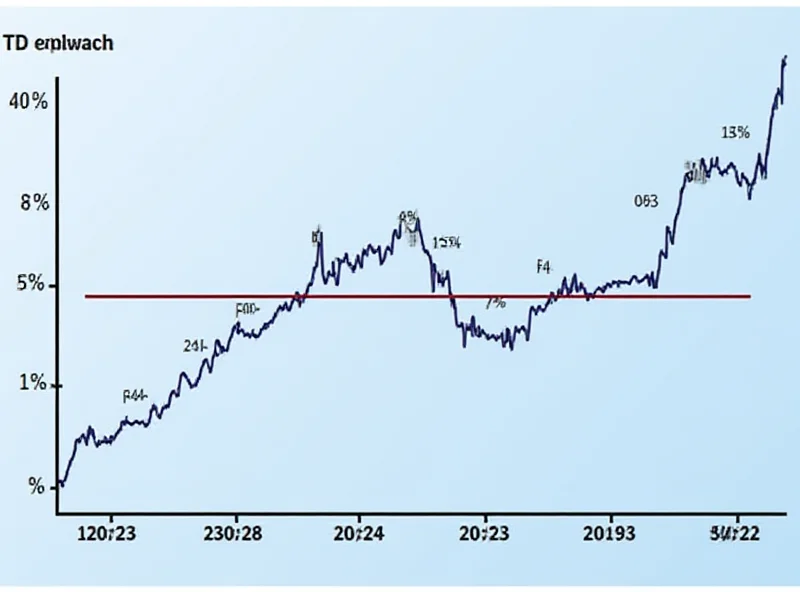

On a brighter note, Fiverr International (NYSE: FVRR) is making waves with its innovative approach to empowering freelancers. The company held its fourth-quarter 2024 earnings call on February 19, 2025, reporting a 13% revenue growth and a 20% adjusted EBITDA margin. This showcases their strong performance amidst continued pressure on small business spending.

A key highlight is the impressive growth in Fiverr's services segment. Services revenue reached $88.4 million, representing a 62% year-over-year increase. This growth is attributed to the success of Fiverr Ads, Seller Plus, and AutoDS. Services revenue now accounts for 23% of Fiverr's total revenue in 2024, up from 15% in 2023. This indicates a significant shift beyond the company's traditional marketplace model.

"We are excited about the potential of AI to further enhance the freelancer experience and drive growth for Fiverr," said a company spokesperson.

These developments highlight the diverse factors influencing stock activity, from investor decisions to analyst ratings and innovative strategies implemented by companies themselves.