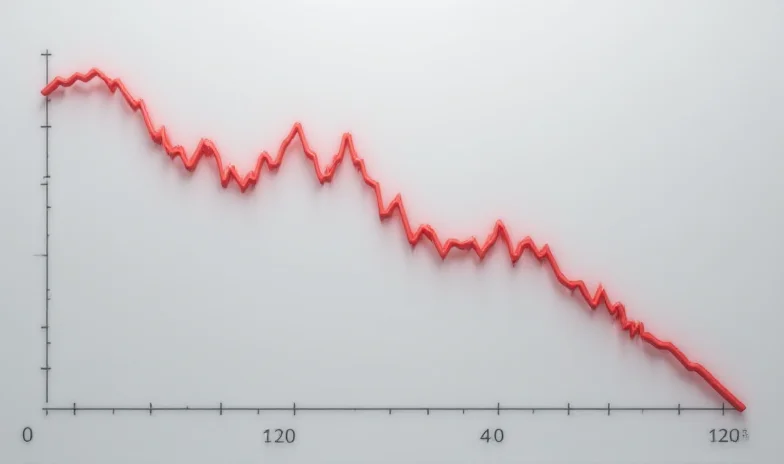

The stock market is a whirlwind of activity, and recent days have seen a flurry of analyst downgrades and companies hitting new lows. Here's a quick roundup of some notable movements.

Analyst Downgrades Shake Things Up

Several companies have felt the impact of analyst downgrades. Adient plc (NYSE:ADNT) experienced a significant gap down after StockNews.com downgraded the stock from a "buy" to a "hold" rating. The stock opened at $13.85, down from a previous close of $14.74, eventually settling at $13.80 with a trading volume of 201,100 shares.

Foot Locker, Inc. (NYSE:FL) also felt the sting, hitting a new 52-week low after Jefferies Financial Group lowered their price target from $22.00 to $19.00, maintaining a "hold" rating. Shares traded as low as $17.01. This shows the significant impact analyst opinions can have on investor confidence.

ProPetro Holding Corp. (NYSE:PUMP) wasn't immune either. Shares gapped down before trading after Barclays lowered their price target from $12.00 to $11.00. The stock opened at $7.26, below its previous close of $7.67. Barclays maintains an "overweight" rating on the stock, despite the price target reduction.

New Lows and Insider Activity

CCC Intelligent Solutions Holdings Inc. (NYSE:CCCS) reached a new 52-week low following substantial insider selling. Director Eric Wei sold a whopping 42,000,000 shares, causing the stock to dip to $9.76 before closing at $9.81. The high trading volume of 933,063 shares indicates considerable market attention on the stock.

“Insider selling can often trigger concerns among investors, leading to further price declines,” noted one market analyst. “It’s crucial to look at the context and reasons behind the sale, but the immediate reaction is often negative.”

Other Notable Mentions

In other news, Citizens (NYSE:CIA) is expected to announce its quarterly earnings on March 13th. Analysts are projecting earnings of $0.10 per share and revenue of $64.66 million for the quarter. Shares of CIA opened at $4.64, up 1.9%.

Finally, NPK International (NYSE:NPKI) is being compared to its rivals in the "Oil & gas field machinery" industry. The analysis focuses on dividends, risk, earnings, valuation, profitability, analyst recommendations, and institutional ownership. Investors are always looking for an edge, and comparing companies within the same industry is a common strategy.

The stock market remains a dynamic and unpredictable environment. Investors should stay informed and conduct thorough research before making any investment decisions.