The stock market is a dynamic landscape, and recent activity reveals shifts in investor sentiment towards several key players. Let's take a look at some of the latest developments involving Meta Platforms, Axcelis Technologies, and SpringWorks Therapeutics.

Meta Platforms: A Mixed Bag

Meta Platforms, Inc. (NASDAQ:META), the parent company of Facebook, Instagram, and WhatsApp, has seen both increased and decreased investment from major players. Crown Wealth Group LLC increased its stake in Meta by 5.8% in the fourth quarter, according to their recent filing with the Securities & Exchange Commission (SEC). They now hold 2,502 shares after acquiring an additional 138 shares. This indicates a positive outlook from Crown Wealth Group on Meta's future performance.

However, not all firms are bullish on Meta. Otter Creek Advisors LLC lowered its position in Meta shares by 18.2% during the same period, according to their Form 13F filing with the SEC. They sold 1,798 shares, leaving them with 8,102 shares. This reduction suggests that Otter Creek Advisors may have concerns about Meta's short-term or long-term prospects. These moves highlight the complex and sometimes contradictory signals within the investment community regarding Meta's future.

Axcelis Technologies: A "Hold" Recommendation

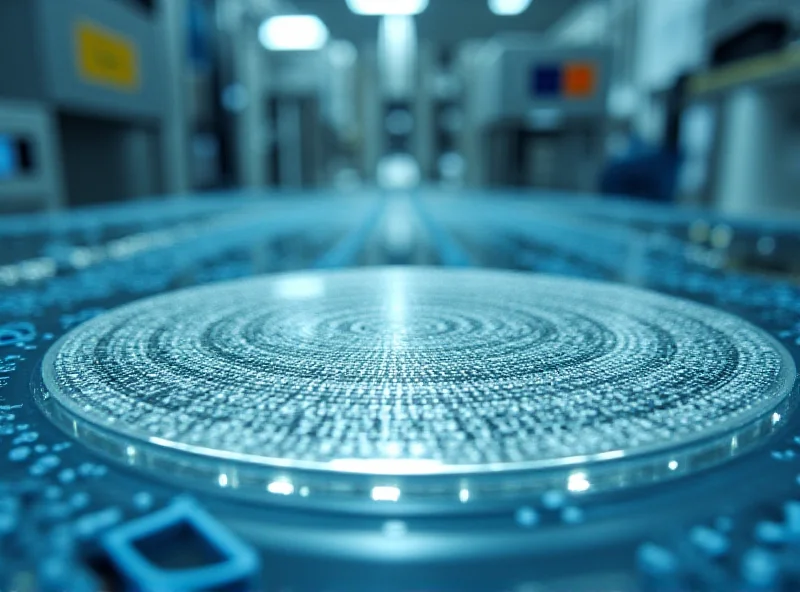

Axcelis Technologies, Inc. (NASDAQ:ACLS), a company specializing in ion implantation equipment for the semiconductor industry, has received a consensus recommendation of "Hold" from seven research firms, according to Marketbeat Ratings reports. Four investment analysts have rated the stock with a hold recommendation, while three have issued a buy recommendation. The average 12-month target price is set at $154.00. This suggests that analysts are cautiously optimistic about Axcelis, seeing potential for growth but also acknowledging potential risks.

SpringWorks Therapeutics: A Growing Investment

Mutual of America Capital Management LLC increased its stake in shares of SpringWorks Therapeutics, Inc. (NASDAQ:SWTX) by 1.6% during the fourth quarter, according to Holdings Channel.com. The fund now owns 116,932 shares of the company's stock after purchasing an additional 1,898 shares during the period. This increased investment signals confidence in SpringWorks Therapeutics and its potential for future growth.

“Investing in pharmaceutical companies requires careful analysis,” says financial analyst Sarah Chen, "but the increase from Mutual of America Capital Management LLC suggests a positive outlook for SpringWorks Therapeutics."

These recent stock moves highlight the ever-changing dynamics of the market. While some firms are increasing their positions in companies like Meta and SpringWorks, others are reducing their stakes or maintaining a neutral stance. Investors should carefully consider these factors and conduct their own research before making any investment decisions.