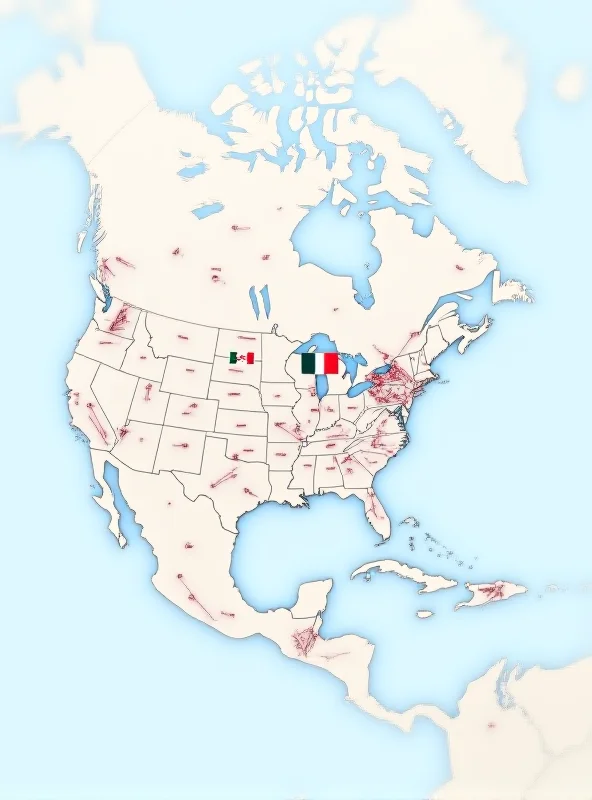

Global stocks are poised for a potential rebound as investors express optimism following hints of tariff relief from U.S. Commerce Secretary Howard Lutnick. Lutnick suggested the possibility of lowering tariffs, particularly for key trading partners like Canada and Mexico, sparking renewed hope in the market.

Potential Tariff Relief for Canada and Mexico

Donald Trump may be considering meeting Canada and Mexico "halfway" on tariffs, according to Lutnick. An announcement could come as early as Wednesday, signaling a potential shift in trade policy. This news has been welcomed by investors concerned about the impact of tariffs on global economic growth. The iShares MSCI Canada ETF (NYSEARCA:EWC) has seen increased investment, with IFP Advisors Inc. boosting their stock position by 141.4% in the fourth quarter, demonstrating confidence in the Canadian market.

"The possibility of tariff relief is a positive sign for the global economy," said one market analyst. "It could ease trade tensions and boost investor confidence."

Analyst Actions and Stock Performance

While the tariff news offers a glimmer of hope, other financial institutions are making adjustments to their stock positions. National Bank of Canada (TSE:NA) hit a new 52-week low after UBS Group lowered their price target. Shares traded as low as C$0.01 before closing at C$119.60, indicating significant volatility.

Conversely, Royal Bank of Canada issued a positive forecast for IMI (LON:IMI) stock, raising the price objective from GBX 2,250 ($28.78) to GBX 2,400 ($30.70) and maintaining an "outperform" rating. This suggests a positive outlook for IMI's future performance.

Venture Global Downgraded

In other news, StockNews.com downgraded Venture Global (NYSE:VG) from a "hold" rating to a "sell" rating. The Royal Bank of Canada has also been reporting on Venture Global, indicating ongoing scrutiny of the company's performance. The market is clearly responding to a variety of factors, from potential tariff relief to individual company performance and analyst ratings.

It remains to be seen how these developments will ultimately impact the global economy and individual stock performances. Investors will be closely watching for further announcements regarding tariff policy and monitoring the actions of financial institutions.