The stock market can be a rollercoaster, and recent weeks have been no exception. We've seen dips in various sectors, leaving investors wondering where to turn. While market volatility can be unsettling, it often presents opportunities to buy into strong companies at discounted prices. Let's take a look at some of the recent trends and potential investment plays.

Tech Stocks Under Pressure

ASX 200 tech stocks experienced a notable downturn recently. While the exact reasons can be complex and multifaceted, the drop highlights the inherent risks in the technology sector. Market corrections are a natural part of the economic cycle, and these dips can be a chance to reassess your portfolio and identify undervalued assets. As one analyst noted, "Getting caught up in short-term market movements is a mistake."

One sector that has seen significant fluctuations is Artificial Intelligence (AI). After a year of explosive growth, many AI stocks experienced a pullback in valuation during the first two months of 2025. This dip, however, may be a golden opportunity for long-term investors.

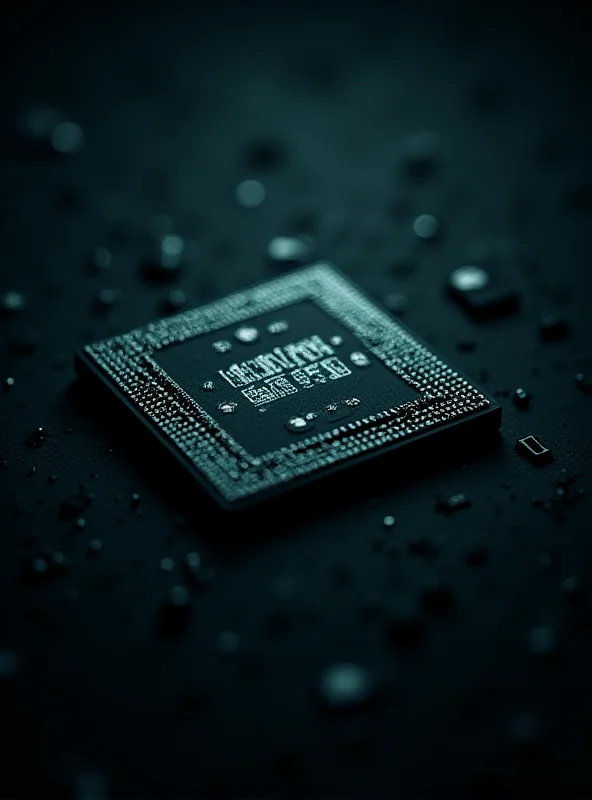

Nvidia: The AI Powerhouse

When it comes to AI, Nvidia (NASDAQ: NVDA) stands out as a dominant force. With an estimated 70% to 95% market share for AI GPUs, Nvidia is essential for nearly every AI company. Their success is driven by their powerful GPUs and the CUDA platform, which allows developers to customize environments and optimize performance. "There is simply no better stock to play the AI revolution that is currently unfolding," claims one expert.

While competition is inevitable, Nvidia's scale, reputation, and the lock-in effect of the CUDA platform give it a significant competitive advantage. Consider this stock if you're looking for a long-term play in the AI space.

Beyond AI: Other Opportunities

The tech sector isn't the only area with potential. Palantir (NYSE: PLTR) has seen a 30% decline due to high valuation and geopolitical uncertainty. This dip raises the question: Is it time to buy?

Outside of tech, Devon Energy (NYSE: DVN) presents an interesting case for investors optimistic about the long-term prospects of oil and gas. Their recent performance, including the integration of the Grayson Mill acquisition, suggests strong operational progress.

Finally, consider diversifying your portfolio with other fundamentally strong companies like Micron Technologies (NASDAQ: MU), Airbnb (NASDAQ: ABNB), Vertex Pharmaceuticals (NASDAQ: VRTX), and Enterprise Products Partners (NYSE: EPD). These companies represent a variety of sectors and offer different risk/reward profiles.

Remember, investing involves risk. Always do your own research and consider your individual financial goals before making any investment decisions.