The global economic landscape is becoming increasingly tense as tariffs and trade disputes ripple across multiple sectors. From the automotive industry to critical port infrastructure, nations are bracing for the impact of escalating trade wars.

Automakers Sound the Alarm

Automakers are warning that new tariffs could send US car prices soaring by as much as 25%.  Critics argue that such a move would disproportionately hurt US brands operating within North America's highly integrated automotive industry, handing a competitive advantage to foreign rivals. This could lead to job losses and a weakening of the American automotive sector.

Critics argue that such a move would disproportionately hurt US brands operating within North America's highly integrated automotive industry, handing a competitive advantage to foreign rivals. This could lead to job losses and a weakening of the American automotive sector.

“Tariffs are inflationary and can undermine revenue and earnings,” warns a strategist from the Wells Fargo Investment Institute, highlighting the broader economic concerns surrounding the current trade climate.

Panama Ports Change Hands

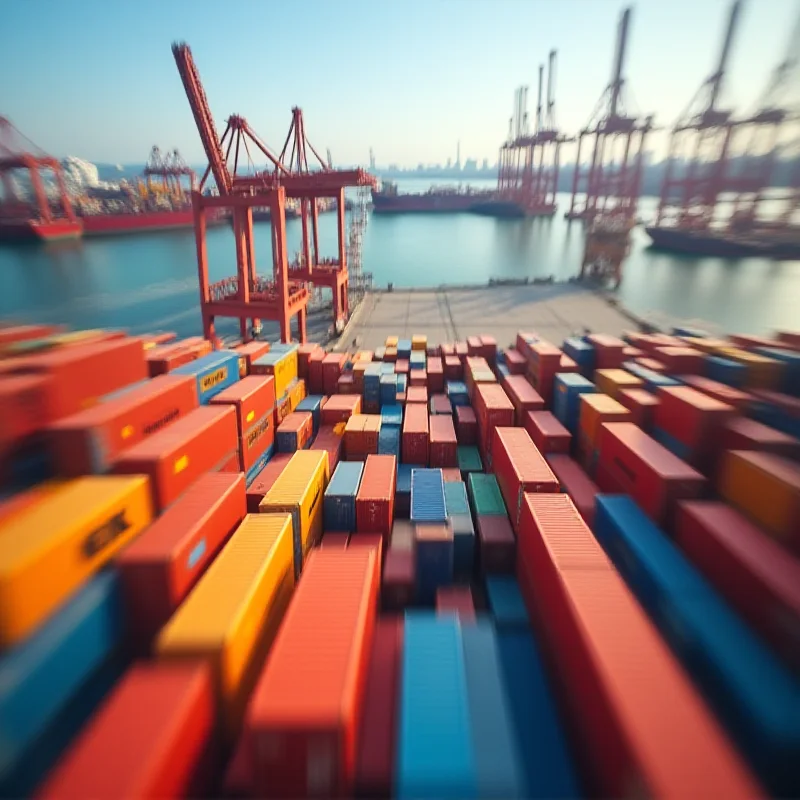

In a potentially significant geopolitical shift, a BlackRock-led group has reportedly taken control of key Panama Ports from a Chinese firm. This takeover allegedly occurred under pressure from the US, signaling a possible realignment of strategic maritime assets.  The move underscores the increasing influence of geopolitical and financial dynamics in shaping global trade routes and infrastructure.

The move underscores the increasing influence of geopolitical and financial dynamics in shaping global trade routes and infrastructure.

Retaliatory Measures Mount

Mexico is preparing to impose retaliatory tariffs on the United States, joining China and Canada in responding to US trade policies. This tit-for-tat approach is escalating the trade war and creating uncertainty for businesses and consumers alike. Canada has already announced tariffs on over $100 billion of American goods, to be implemented over a 21-day period.

The interconnectedness of the global economy means that these tariffs will have far-reaching consequences. As trade tensions continue to rise, businesses must adapt to the shifting landscape and prepare for potential disruptions to supply chains and increased costs for consumers.

The situation remains fluid, and the long-term effects of these trade disputes are yet to be seen. One thing is clear: the global economy is entering a period of heightened uncertainty.