Former US President Donald Trump continues to influence global markets, impacting both the cryptocurrency sector and traditional currencies. His recent remarks regarding digital assets have sent crypto prices soaring, while his broader economic policies appear to be contributing to a decline in the US dollar's global value.

Crypto Market Reacts to Trump's Endorsement

Following a recent market shake-out, cryptocurrency prices have seen a significant jump after Trump identified digital assets like Solana as potential inclusions in a strategic reserve. This endorsement has injected a renewed sense of confidence into the market. The Solana token, in particular, experienced a notable surge. The suggestion that these digital assets could be part of a strategic reserve has resonated well with investors.

However, not all news surrounding Solana has been positive. The SOL network recently introduced 11.2 million new tokens into circulation, a move that has diluted the existing supply and put downward pressure on the Solana price. "This token unlock event created fear and uncertainty in the market," said one analyst. Amidst this volatility, some investors are turning to alternative opportunities like the DTX Exchange, which is currently running a $15 million presale and touting the potential for 2x returns.

Dollar Declines, Brazil Benefits

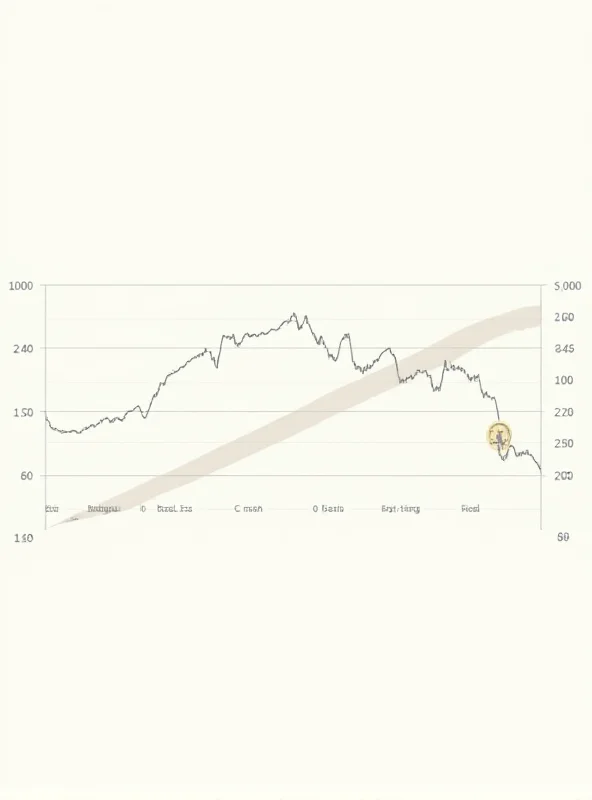

Beyond the crypto sphere, Trump's influence is also being felt in the currency markets. The American currency ended this Wednesday with a 2.7% drop against the Brazilian real after two days of markets being closed in Brazil due to Carnival. This decline is attributed, in part, to actions linked to Trump's policies, which have contributed to a broader global weakening of the US dollar. Brazil, in particular, has benefited from this shift.

However, domestic political factors within the United States are limiting the extent of the dollar's decline. While Trump's actions have created downward pressure, internal economic policies are providing some support. It's a complex interplay of global and domestic forces shaping the currency markets.

Looking Ahead

The influence of Donald Trump on both the cryptocurrency market and the global currency landscape is undeniable. His endorsement of digital assets has boosted crypto prices, while his broader economic policies are contributing to a decline in the US dollar. How these trends will evolve in the coming months remains to be seen, but one thing is clear: Trump's actions continue to have a significant impact on global markets.

The market will continue to watch closely as these trends develop, with investors and analysts alike keenly observing the interplay between political influence and market dynamics.