President Trump's policies are once again sending shockwaves through global markets. From imposing tariffs on key trade partners to potentially reshuffling the satellite landscape in Ukraine, the financial world is bracing for impact. But what does it all mean for investors?

Tariffs and Trade Wars: A Rocky Start?

The recent imposition of tariffs on major US trade partners, including China and Canada, has triggered retaliatory measures and sparked concerns about a potential trade war. Stocks have reacted negatively, reflecting investor unease. "The markets remain fixated on the paradigm-shaking policies that the Trump administration continues to advertise are coming," notes one market analyst.

The S&P 500 has seen a slight decline since Trump took office. Will this downward trend continue, leading to a market crash? Or could stocks surprise everyone and soar during the remainder of his second term? History, as they say, may offer some clues.

Gold and Silver: A Safe Haven?

Amidst the uncertainty, precious metals like gold and silver are drawing attention as potential safe havens. Veteran precious metals trader Drew Rathberger suggests investors should watch out for industry pitfalls and prepare for potential market reactions in 2025. "The markets remain fixated on the paradigm-shaking policies that the Trump administration continues to advertise are coming," he stated.

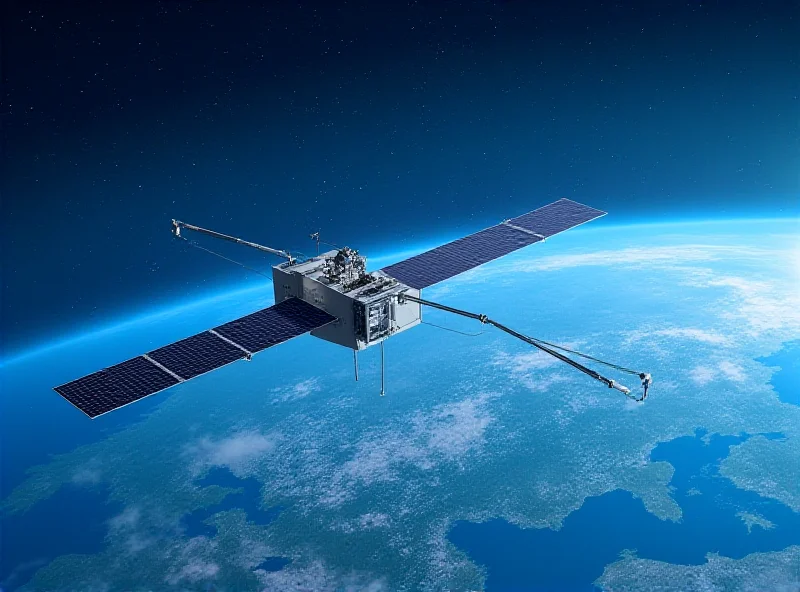

Eutelsat's Unexpected Surge

In a surprising twist, Eutelsat's shares have soared by 200% in just two trading sessions. This surge is fueled by speculation that Eutelsat satellites could replace Elon Musk's Starlink in Ukraine, capitalizing on political tensions between Trump and Zelenski. This highlights how geopolitical events can create unexpected opportunities in the market.

The confrontation between Trump and Zelenski opens the door for other operators to replace Starlink.

Ultimately, the impact of Trump's policies on the markets remains to be seen. Investors should remain vigilant, informed, and prepared for potential volatility.