The market is a complex beast, constantly reacting to a multitude of factors. Lately, two key elements have been dominating headlines: inflation reports and President Trump's trade policies, particularly tariffs. How are these interconnected forces shaping the investment landscape? Let's dive in.

Inflation's Hot Streak

Recent PPI (Producer Price Index) inflation figures have come in hotter than expected. While some might panic, the stock market has largely shrugged it off. This resilience suggests investors are looking beyond the immediate numbers, perhaps anticipating that these inflationary pressures are temporary or already factored into future earnings.

But the underlying questions remain: Are technological advancements, particularly the rise of AI, contributing to job losses? The data is complex, and the debate continues. "It's crucial to analyze the data behind AI and the labor market," says one market analyst. "Investing in AI is almost a necessity for companies looking to stay competitive."

Trump's Tariff Playbook

President Trump's approach to trade, characterized by the use of tariffs, continues to be a major market mover. Just recently, news broke of "reciprocal tariffs" announced by the President, signaling a potential escalation in trade tensions. Speaking from the Oval Office, Trump stated, "They charge us a tax or tariff and..." leaving little room for interpretation.

While these announcements might initially send investors scrambling for defensive positions, they also create opportunities. Some analysts believe that "these tariff threats have also created some incredible opportunities for sharp-eyed investors." For example, certain mining companies may be trading at irresistible prices due to tariff-related uncertainty.

A Game-Changing Shift?

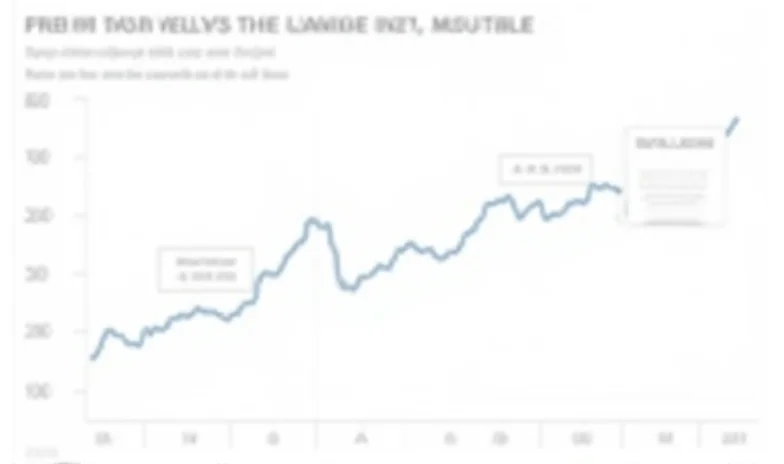

So, what's the big picture? According to InvestorPlace's Market 360, we're witnessing a "game-changing shift" emerging in the markets. This shift is likely driven by the interplay between inflation, tariffs, and technological disruption. It's a time of both risk and opportunity.

"The key is to understand the underlying trends and position yourself accordingly," advises a leading investment strategist. "Don't just react to the headlines; analyze the data and identify the companies that are best positioned to thrive in this new environment."

Navigating this complex landscape requires careful analysis and a willingness to adapt. Keep a close eye on inflation reports, monitor trade developments, and stay informed about the latest technological advancements. By doing so, you can potentially capitalize on the opportunities that arise in this ever-evolving market.

Ultimately, the market's reaction to these forces will determine the winners and losers. Stay informed, stay vigilant, and be prepared to make your own big play.