Former President Donald Trump's tariff policies are once again making waves in the global economy. Concerns over potential new tariffs, particularly impacting trade with Mexico and Canada, have triggered a downturn in the US stock market. Simultaneously, European defense firms are experiencing a surge in their stock prices, highlighting the complex and often contradictory reactions to Trump's trade strategies.

The Impact on US Markets

The prospect of tariffs on goods from Canada and Mexico has created significant uncertainty in financial markets. Investors are wary of the potential for increased costs and disruptions to supply chains. This anxiety has manifested in a decline in US stock values. As one analyst noted, "The market hates uncertainty, and tariffs are a major source of uncertainty."

According to a recent report by the Bureau of Economic Analysis, the US economy may be facing underlying weaknesses, adding to the market's vulnerability. Some economists suggest that the economic picture is not as rosy as it appears on the surface, and that Trump inherited a more fragile economy than previously believed. This combination of factors has created a perfect storm for market volatility.

European Defense Firms Soar

While US stocks are struggling, European defense companies are thriving. This divergence reflects the shifting geopolitical landscape and the potential for increased defense spending in Europe. Investors are betting that heightened global tensions will lead to increased demand for military equipment and services. This bullish sentiment is driving up the stock prices of European defense firms.

A North American Trade War?

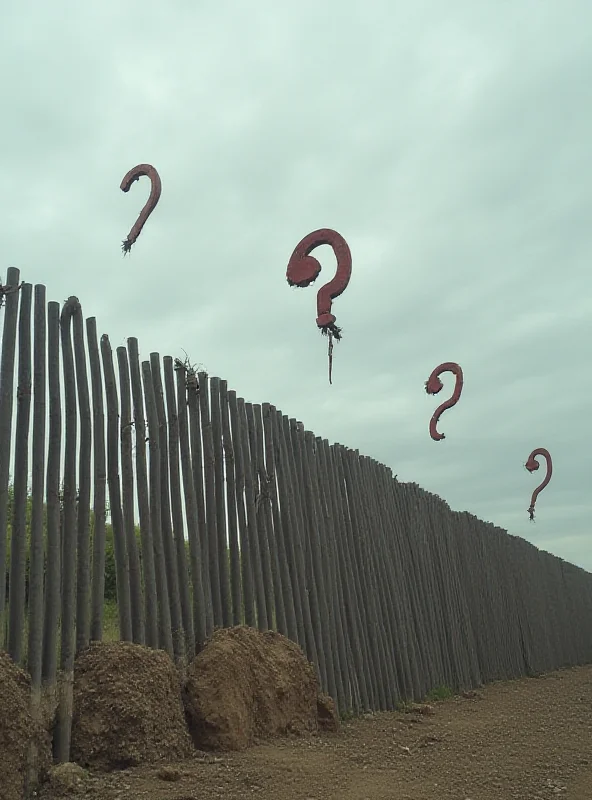

The potential for a North American trade war looms large. Trump's threats to impose tariffs on goods from Canada and Mexico have raised concerns about the future of trade relations between the three countries. Prices along the border have already begun to rise in anticipation of these tariffs, and experts warn that a full-blown trade war could have devastating consequences for the global economy.

"The prospect of a North American trade war has thrown the global economy into turmoil."

The tariffs, originally negotiated in a last-minute deal, are now set to take effect, potentially impacting a wide range of products purchased by the United States from its neighbors. The long-term implications of these policies remain to be seen, but the immediate impact on markets and trade relations is already being felt.

The situation is evolving rapidly, and businesses and investors are closely monitoring developments. Whether Trump's tariff policies will ultimately benefit the US economy or lead to a protracted trade war remains to be seen. One thing is clear: the global economy is bracing for impact.