Donald Trump's "America First" agenda, once celebrated by investors, is now creating significant headwinds for global businesses. From tariff wars to interest rate adjustments, the consequences of his policies are being felt across various sectors and regions.

US Stocks Stumble After Initial Trump Bump

Remember back when Donald Trump rang the opening bell at the New York Stock Exchange? The cheers and chants of "United States" echoed the optimism that initially propelled US stocks to record highs. However, that initial euphoria has faded, and those gains are now facing challenges.

The article highlights the initial investor euphoria sparked by Donald Trump's appearance at the New York Stock Exchange, which drove US stocks to record highs, but indicates that these gains later faced difficulties due to the failure of bets on his 'America First' agenda.

ECB Responds to Global Instability

The European Central Bank (ECB) is also feeling the pressure. Citing a situation "that changes radically from one day to the next," the ECB recently lowered its main interest rate by 0.25 points. ECB President Christine Lagarde admitted the institution is "navigating by sight" due to tensions with the United States over the Ukraine issue and expected rearmament investments in Europe.

“This is a very uncertain time,” Lagarde stated, hinting at the difficulty in predicting future economic trends amidst the ongoing geopolitical tensions.

Whiskey Woes and Tariff Troubles

The impact of tariffs is being felt at the consumer level as well. Lawson Whiting, CEO of Brown-Forman, the company behind Jack Daniel's whisky, is furious about Canadian provinces banning the sale of American alcohol. He argues this is "worse than tariffs" because it completely eliminates profits for American companies.

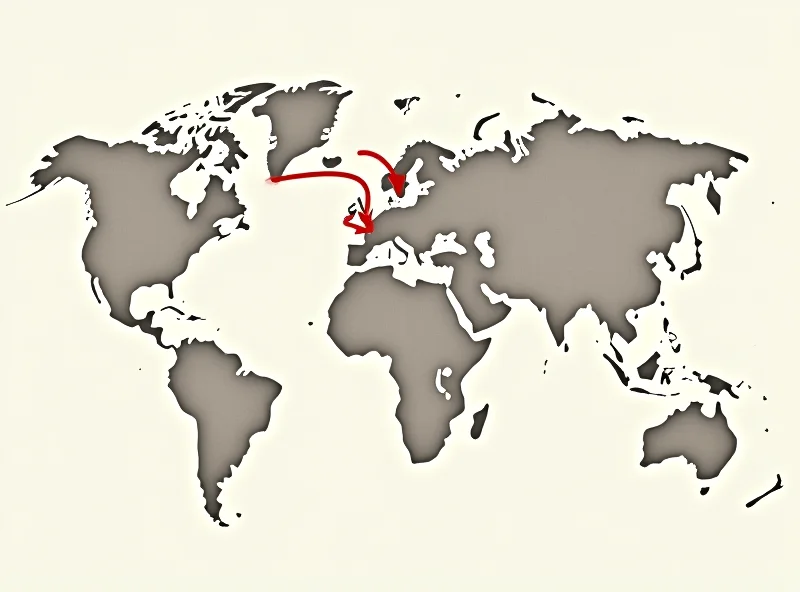

The Canadian ban is a direct response to President Trump's imposition of 25% tariffs on goods imported from Canada. The move highlights the complex and often unpredictable consequences of trade wars.

The Spanish company Puig is also feeling the pinch. Despite the US being its second most profitable market, Puig's shares fell nearly 7% after it acknowledged that it had not factored in a 25% tariff into its 2025 forecasts.

These are just a few examples of how Donald Trump's trade policies are creating ripple effects across the global economy. From stock market fluctuations to product bans, the consequences are far-reaching and continue to evolve.

Even the Japanese company Seven & i Holdings, owner of the 7-Eleven convenience store chain, has appointed its first foreign CEO, tasked with reformulating its business to avoid a US$ 47 billion acquisition offer – a move potentially linked to the changing global economic landscape.

The interconnectedness of the global economy means that policy decisions in one country can have significant consequences for businesses and consumers around the world.