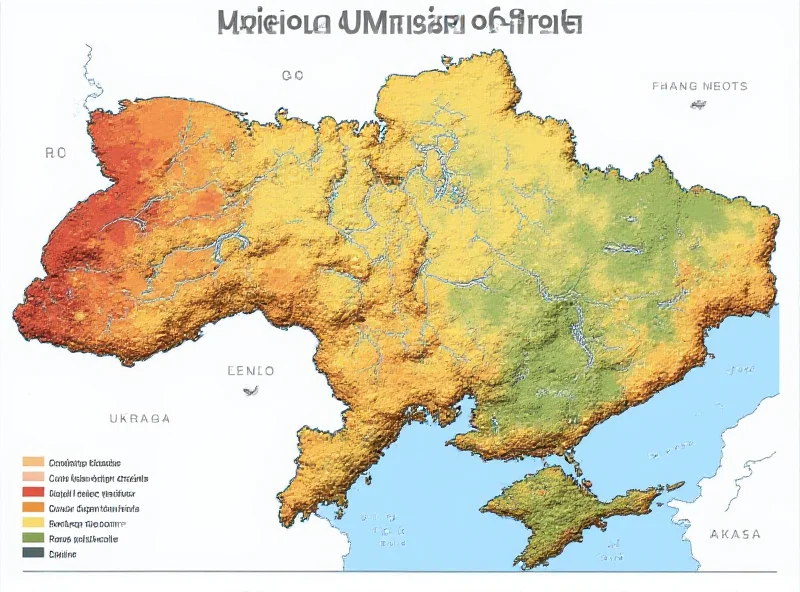

A potential economic boon could be on the horizon for the United States, stemming from a deal involving rare-earth minerals in Ukraine. Kevin Hassett, a former economic advisor to President Trump, suggests that this agreement could generate a substantial $20 billion for the US economy.

Rare Earth Riches

The specifics of the deal remain somewhat vague, but the potential for a $20 billion windfall underscores the strategic importance of rare-earth minerals. These minerals are crucial components in a wide range of modern technologies, from smartphones and electric vehicles to defense systems. Securing access to these resources is a key priority for many nations, and this deal could significantly bolster the US supply chain.

“This is a game changer for American industry,” said one industry analyst, speaking on condition of anonymity. “Having a reliable source of rare earth minerals is essential for our future competitiveness.”

Stock Buybacks and Analyst Buzz

In other business news, AAON (NASDAQ:AAON) has announced a plan to repurchase $30 million of its outstanding stock. The announcement, reported by RTT News, indicates the company will buy back up to 0.5% of its stock through open market purchases. This move is often seen as a sign of confidence in the company's financial health and future prospects.

Meanwhile, analysts are weighing in on several other companies. NexPoint Residential Trust, Inc. (NYSE:NXRT) has received an average recommendation of 'Moderate Buy' from five brokerages, with a price target of $49.00. TPG RE Finance Trust, Inc. (NYSE:TRTX) has been assigned a consensus "Buy" recommendation from five ratings firms, with an average twelve-month price target set at $8.92.

Rentokil Initial's Q4 Earnings

Finally, Rentokil Initial plc (RTO) recently held its Q4 2024 earnings call. The transcript of the call, which is now available, provides detailed insights into the company's financial performance, strategic initiatives, and operational updates. Investors and analysts are likely scrutinizing the transcript for clues about the company's future direction.

These developments highlight the dynamic nature of the global economy and the ongoing efforts to secure resources, enhance shareholder value, and drive growth.